Oil Market Volatility Hits Record High Amid COVID-19 Economic Crisis: EIA

Since the beginning of this year, crude oil prices fell significantly in response to the economic contraction caused by the COVID-19 pandemic and the sudden crude oil glut after the Organization of the Petroleum Exporting Countries and partner countries suspended agreed production cuts. Daily price changes for the U.S. benchmark crude oil West Texas Intermediate have been highly volatile amid falling demand and growing supply, according to a March 27 report from the U.S. Energy Information Administration.

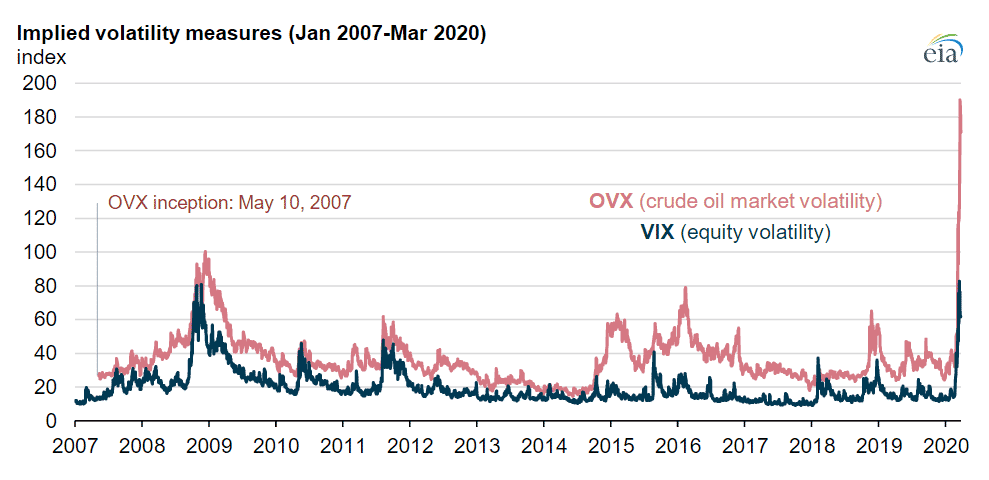

Crude oil market volatility, or OVX, and equity volatility, or VIX, have been relatively high in March. OVX is calculated using “movements in the prices of financial options for WTI, the light, sweet crude oil priced at Cushing, Oklahoma;” VIX measures the “volatility of Standard and Poor’s 500 – a stock market index of 500 large companies” in the U.S.

Crude oil volatility is typically higher because OVX represents changes in one commodity and VIX covers a diverse group of 500 companies. However, crude oil market volatility has been even higher in March. VIX index measured 82.7 on March 16, a level higher than any point during the financial crisis of 2008–2009; OVX reached 190 on March 20, the highest since its inception in May 2007.

The 25 percent fall on March 9 and the 24 percent fall on March 18 were the two largest percentage declines in the WTI futures price since at least 1999. The following days saw price rises of 10 percent and 24 percent on March 10 and March 19, respectively, due likely to various countries’ announcements about fiscal and monetary policy.

Ample fluctuations in quick succession like this have only been seen during the 2008-09 financial crisis, which saw the largest price increase of 18 percent on Sept. 22, 2008, followed by the largest decrease of 12 percent on the next day.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL