PJM Capacity Auction Prices Rise by 22 Percent Amid Growing Demand and Reliability Pressures

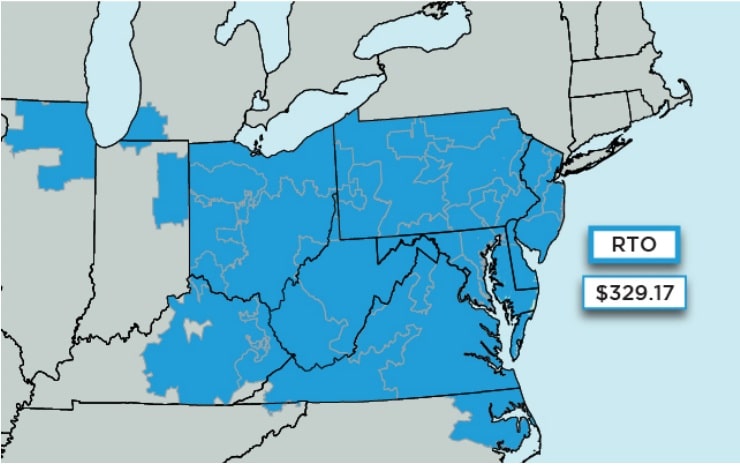

PJM Interconnection LLC’s capacity market auction for the 2026/2027 delivery year cleared at a record-high price of $329.17 per megawatt-day (MW-day), about 22 percent higher than last year’s auction, according to the results announced on July 22. The clearing price hit the price cap approved by the Federal Energy Regulatory Commission following a ninefold increase in prices in the July 2024 auction.

The auction secured 134,311 megawatts of unforced capacity to meet peak electricity needs for over 67 million people across 13 states and the District of Columbia. An additional 11,933 MW was procured under the Fixed Resource Requirement, bringing the total capacity to 146,244 MW, just 139 MW above the projected requirement, underscoring a tightening supply-demand balance.

In April, FERC approved a price cap of $329.17/MW-day and floor of $177.24/MW-day to address the challenges that PJM is currently facing, including rapid load growth, interconnection queue issues, and a compressed auction schedule. While most of the PJM footprint cleared at the cap, the Baltimore Gas and Electric and Dominion zones cleared higher last year, at $466.35/MW-day and $444.26/MW-day, respectively. PJM estimates the new prices may translate to a 1.5 to 5 percent rise in consumer electricity bills, depending on how costs are passed on. Some regions may even see reduced rates due to lower zonal prices.

Despite the short one-year lead time, indicators show a market response to higher prices. New generation and capacity upgrades totaled 2,669 MW UCAP, marking the first increase in four years. Since the prior auction results were released, 17 generation units have withdrawn deactivation plans, totaling around 1,100 MW. Additionally, PJM’s Reliability Resource Initiative has attracted over 11,000 MW of new and upgraded generation proposals.

The cleared resource mix includes 45 percent natural gas, 22 percent coal, 21 percent nuclear, and smaller shares from hydro, wind, and solar. Meanwhile, demand continues to rise, with PJM’s peak load forecast increasing by over 5,400 MW year-over-year, driven by electrification, economic growth, and data center expansion.

Several market rule changes shaped this auction, including expanded must-offer requirements for all resource types, a new capacity price cap and floor, the elimination of the energy efficiency product, and special treatment for reliability must-run units.

Looking ahead, PJM plans to accelerate integration of new resources, with over 63,000 MW of projects set for review through 2026 and partnerships, including one with Google, to streamline interconnection processes using AI.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL