RGGI Auction Clears at Record High Prices, Generates Over $183 Million

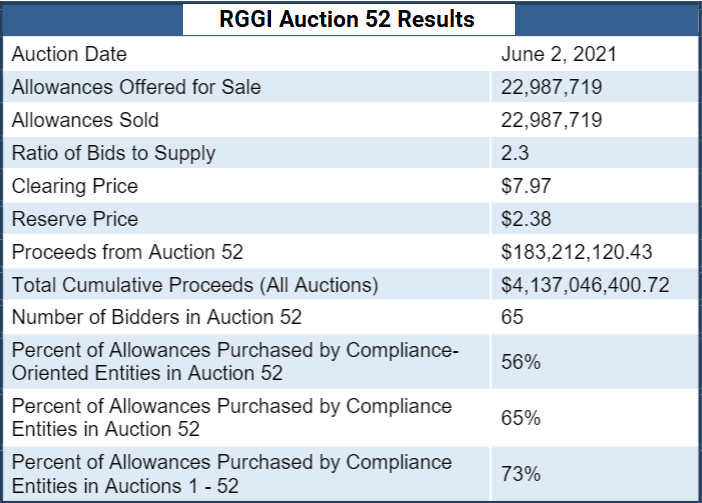

The 52nd quarterly carbon auction of the Regional Greenhouse Gas Initiative, or RGGI, the nation’s first market-based emissions regulation program, sold all of the nearly 23 million CO2 allowances offered. Permits were sold at a clearing price of $7.97, the highest price to date and a 4.87 percent increase from the previous auction held in March. The auction generated $183 million that will be invested in strategic initiatives, including energy efficiency, renewable energy, and emissions reduction programs.

RGGI has 11 participating member states across the east: Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island, Vermont, and Virginia. Virginia represents almost a quarter of the allowances sold, followed closely by New York at 23.5 percent and then by New Jersey at a little over 13 percent. This is the second auction in which Virginia participated, following the enactment of its 2020 Clean Economy Act, which put the state on the path to carbon-free power.

A total of 65 bids were submitted, 45 by compliance-oriented entities and 20 by investors. Compliance entities – firms with compliance obligations – accounted for 65 percent of the allowances purchased. Compliance-oriented entities, which acquire and hold allowances to meet their obligations, bought 56 percent of the allowances.

The largest compliance entity represents 19 percent of the total projected demand for allowances, and approximately half of the projected demand is composed of entities that each account for less than 5 percent each of the total demand. Participation by a large number of entities facilitates the competitive performance of the auction.

RGGI’s market-based approach sets an annually declining limit on carbon emissions and allows polluters to buy or sell permits. In March, RGGI states announced the third adjustment for banked allowances held by market participants for the five-year period from 2021-2025. The adjustment is a reduction in the number of carbon allowances that is being sold over the period. The amount of the reduction is equal to the private bank of allowances at the end of 2020. The adjustment is about 95.5 million allowances at 19.1 million for each year of the five-year period.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL