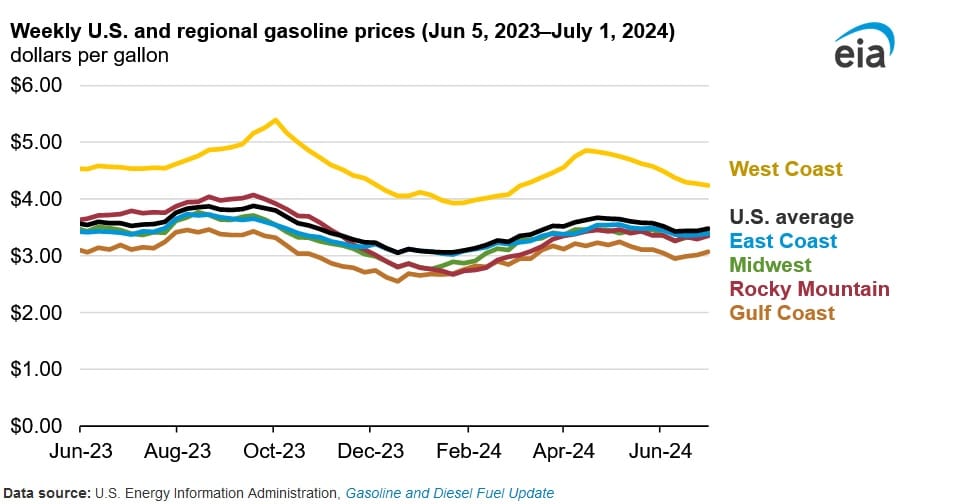

Lower U.S. Gasoline Prices Due to Increasing Inventories: EIA

Average weekly U.S. gasoline prices have lost 19 cents per gallon (gal) in value since the 2024 high recorded on April 22 to $3.48/gal on July 1, according to a July 2 report published by the U.S. Energy Information Administration. The price decline can be attributed to rising gasoline stocks, relatively subdued demand and comparatively lower oil prices.

Robust gasoline stocks have led to lower gasoline prices during the second quarter of 2024. U.S. gasoline stocks were recorded at 226.7 million barrels (m/b) on April 19, down 8.5 m/b compared to the preceding five-year average (2019-2023). U.S. gasoline stocks rose by 7.1 m/b to 233.9 m/b between April 19 and June 21, this was largely identical to the preceding five-year average. The rise in gasoline stocks can be attributed to abnormally large inventory growth in the East Coast, which rose by 4.1 m/b between April 19 and June 21. Seasonal gasoline stock reductions were evident in the Midwest and Rocky Mountains, but were largely offset by higher stock growth in the East Coast.

The increase in inventories in the East Coast was because of higher gasoline imports, in line with seasonality. Historically, 80 percent or more U.S. gasoline imports enter via the East Coast. During the week of April 5, gasoline imports into the East Coast recorded a 2024 low of 381,000 barrels per day (b/d). During the week of June 21, gasoline imports averaged 630,000 b/d, up by 65 percent.

Gasoline inventories have been higher due to higher refinery runs and subdued demand. Refinery runs on the East Coast during 2024, have been above 2022 and 2023 levels for the majority of the year. In terms of gasoline demand, the agency’s proxy for U.S. gasoline consumption is down one percent so far in 2024 compared to 2023 levels and lower than the 2015 to 2019 range.

Brent crude oil prices are a key driver of U.S. gasoline prices. Brent crude oil prices declined between early April and early June. Brent crude oil prices hit a 2024 high of $93 per barrel on April 12 and declined to $76 per barrel on June 5. Brent crude oil prices initially increased due to heightened geopolitical tensions and OPEC+s declaration to extend production reductions. Oil prices softened thereafter with easing geopolitical tensions and OPEC’s announcement that there could be possible growth in crude oil supply.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL