Proved Reserves of Oil and Natural Gas Saw Slight Increase Last Year: EIA

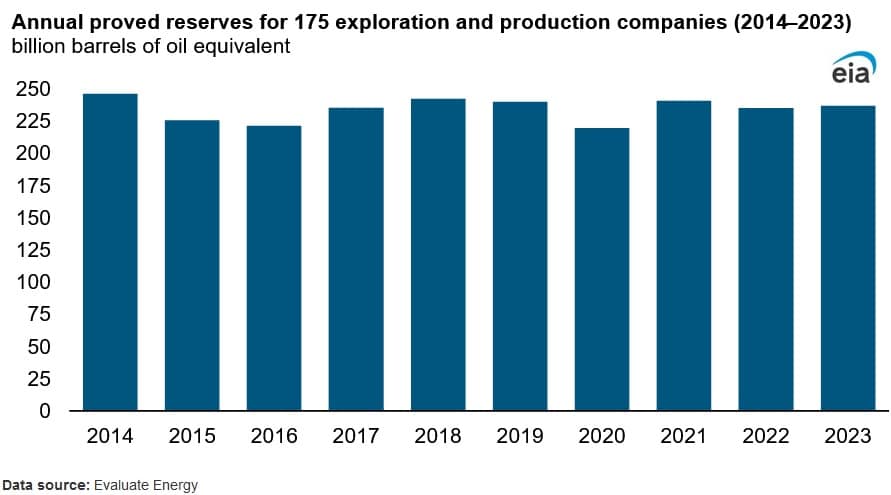

Global proved reserves of crude oil and natural gas that were held by 175 publicly traded exploration and production businesses rose by 2 billion barrels of oil equivalent, or one percent during 2023, according to an Aug. 12 report published by the U.S. Energy Information Administration. Proved reserves refer to the estimated volumes of hydrocarbon resources, which, through analysis of geologic and engineering data, are shown with reasonable certainty to be recoverable under current economic and operating conditions.

Companies’ valuations of their proved reserves of natural gas and crude oil change every year due to a number of factors including: production, purchases of proved reserves, findings of new resources and amendments to current reserves determined by market prices and up to date data from drilling.

The agency estimated that the 175 businesses included in the examination accounted for around 50 percent of the petroleum production by non-OPEC countries during 2023. Usually, companies add most reserves via outlay on exploration and development, leading to proved reserve additions via extensions, improved recovery and discoveries. Companies use their proved reserves by producing oil and gas and selling them to end users or refineries.

The corporations added 14.9 billion barrels of oil equivalent from discoveries, extensions and improved recovery. In addition, 7.6 billion barrels of oil equivalent were added via acquisitions of proved reserves and 3.4 billion barrels of oil equivalent from higher revisions.

Companies could elevate their proved reserves in a number of ways, including procured additions that come from handovers between businesses and do not create new proved reserves and organic proved reserve additions, which are additions that create new proved reserves from discoveries, extensions and improved recovery.

Expenditures for organic proved reserve additions during 2023 rose by 15 percent in real terms, compared to 2022 due to elevated development costs. These costs include both exploration and development costs, as well as unproved reserve acquisitions.

Finding costs, which can be defined as the expense incurred for each additional barrel of oil equivalent of organic proved reserves, for the companies during 2023 rose by 24 percent in real terms compared to last year to $20.06 per barrel of oil equivalent.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL