Gasoline and Diesel Average Taxes Remained Nearly Flat Since January 2024: EIA

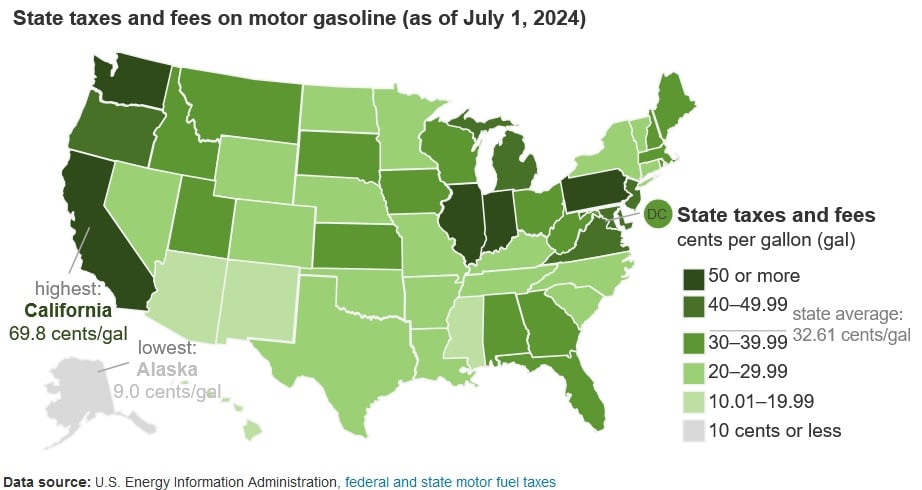

State taxes and fees for diesel and gasoline fuel averaged $0.35 per gallon (gal) of diesel fuel and $0.33 per gal of gasoline as of the start of July 2024, according to a Aug. 20 report published by the U.S. Energy Information Administration. Gasoline and diesel average taxes have been mostly flat since the start of January 2024.

Although the national average tax rates were flat, changes in taxes were evident across states. Gasoline taxes declined in three states, with Kentucky witnessing the greatest decrease, falling by $0.023 to $0.278/gal. Meanwhile, gasoline taxes rose across nine states, with the state of Indiana having the biggest increase of $0.044 to $0.561/gal.

Diesel taxes declined in four states, with California’s tax reduction of $0.042/gal being the largest. Meanwhile, diesel taxes rose in eight states, with the greatest increase in Colorado, rising by $0.0263 to $0.3068/gal.

Federal taxes continue to be $0.184/gal for gasoline and $0.244/gal for diesel, which incorporates excise tax and an extra $0.001/gal from the Leaking Underground Storage Tank Fund.

Alaska, Mississippi and Hawaii had the lowest gasoline and diesel taxes. Alaska’s taxes were at $0.0895/gal for both fuels, while Mississippi’s taxes were at $0.184/gal for both fuels. Hawaii’s taxes for both fuels were $0.185/gal.

California, Illinois, and Pennsylvania were the three states with the highest gasoline taxes. Gasoline taxes were $0.6982/gal, $0.671/gal and $0.587/gal respectively. These three states also had the highest diesel taxes. Diesel taxes were $0.9212/gal for California, $0.746/gal for Illinois and $0.741 for Pennsylvania.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL