High Inventories Caused Decline in West Coast Jet Fuel Margins: EIA

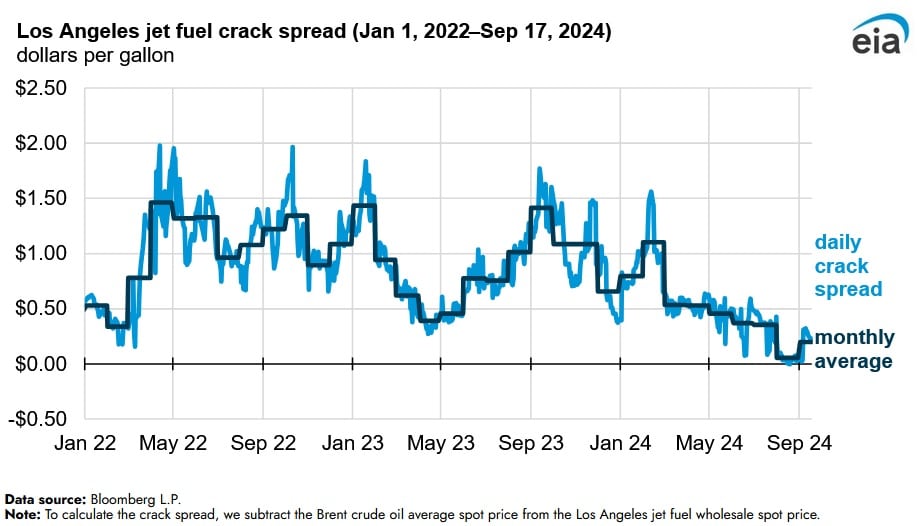

High jet fuel inventories in the U.S. West Coast have led to Los Angeles regional crack spreads to an average of 5 cents per gallon (gal) in August, according to an Sept. 18 report published by the U.S. Energy Information Administration. The crack spread in August was its lowest level in five years. The low crack spread can be attributed to high inventories, with U.S. West Coast inventories surpassing the previous five years for 29 out of 35 weeks so far in 2024.

The crack spread can be defined as the difference in price between products and crude oil and is usually used as an indicator to determine which products are good value for money at certain points in time. The spread can assist refineries in making production decisions.

West Coast jet fuel stocks hit a yearly high of over 12 million barrels during the week which ended on Sept. 6 and have surpassed the preceding five-year average by 20 percent or more for every week since July 12. The increase in West Coast stocks can be attributed to higher refinery production and lower demand for jet fuel compared to pre-COVID 19 levels.

West Coast jet fuel demand was higher during the first six months of 2024 than the previous four years. Despite this, demand remains lower than 2019 levels. The reduction in demand in comparison to 2019 is due to weaker rebound in global air travel to Asia, increased aircraft fuel efficiency and a weaker recovery in West Coast air travel compared to the U.S. average.

Refiners from the West Coast continue to produce jet fuel to produce gasoline, which accounts for the majority of the West Coast’s overall refinery yield. Refiners are regularly constrained to the amount they can increase gasoline yield, since they are required to produce some amount of jet fuel or distillate fuel.

West Coast refinery yields of jet fuel were greater than yields of distillate fuel in 26 out of 35 weeks so far this year. Moreover, refiners outturned more jet fuel as a percentage of their total output in five of the first six months during 2024.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL