Refinery Margins Hit Multiyear Seasonal Lows in September: EIA

Global refinery margins for petroleum refiners are declining, which has led to lower financial profitability from selling petroleum products and refining crude oil, according to an Oct. 15 report published by the U.S. Energy Information Administration.

The reduction in refinery margins can be attributed to relatively low demand for petroleum products, despite the agency’s projection that global refining will increase over the next few years. Majority of the projected growth in refined product output is in the Asia-Pacific (mainly China and India) and the Middle East. The agency projects that between 2.6 million barrels per day (b/d) and 4.9 million b/d of refining capacity will become operational during the 2024-2028 period.

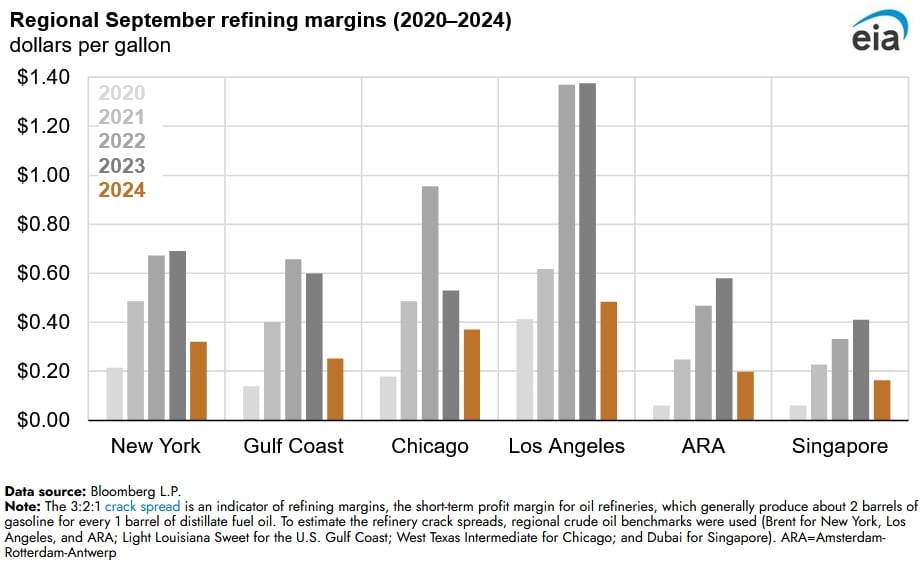

Global refinery margins, as indicated by the 3:2:1 crack spread, have been below the five-year (2019-2023) averages during spring and declined further during the back end of summer and early autumn. During September 2024, monthly average refinery margin declined to its lowest monthly level since 2020, when transportation fuel demand declined significantly, due to the coronavirus related travel restrictions.

The most recent reduction in refinery margins is in contrast to the previous two years. Refinery margins hit lows during 2020, due to the COVID-19 pandemic, thereafter reductions in U.S. refinery capacity and improving petroleum demand contributed to stronger U.S. refinery margins.

Refinery margins have declined due to weak demand for petroleum products, predominantly distillate fuel oil. This year, U.S. product supplies of distillate fuel oil averaged six percent less than during 2023 and eight percent less than during 2019 for the June to September period. The decline can be attributed to lower manufacturing activity and the higher utilization of biofuels instead of petroleum-based diesel fuels on the West Coast. Jet fuel and gasoline usage were marginally lower than 2023 levels for the same months, and six percent below 2019 levels.

Petroleum product consumption has also been low in Europe and China due to weak economic growth. Moreover, increasing use of biofuels, electric vehicles and liquefied natural gas utilization in trucking and transportation is gradually reducing petroleum fuel usage across the majority of Europe and Asia.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL