Natural Gas Prices in the Northwest U.S. and Western Canada Hit Historic Lows in 2024: EIA

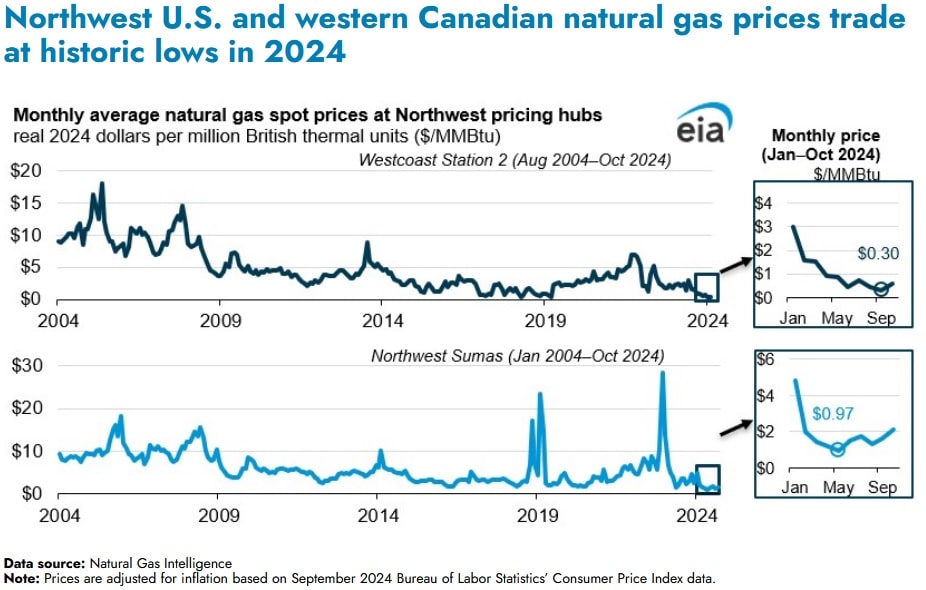

The monthly average price of spot natural gas at western Canada and northwestern U.S. border pricing hubs hit historic lows during the first 10 months of 2024, according to an Nov. 19 report published by the U.S. Energy Information Administration. The price decline can be attributed to firm natural gas production in western Canada, where production has largely risen over the last two years and high natural gas stocks in the region.

The average daily spot natural gas price averaged $1.04 per million British thermal units (MMBtu) at Westcoast Station 2, the western Canada benchmark during 2024 through October, hitting a monthly average low of $0.31/ MMBtu during September. The average daily spot natural gas price averaged $1.87/ MMBtu at Northwest Sumas, the key pricing hub for natural gas in the U.S. Pacific Northwest during the first 10 months of the year, hitting a monthly average low of $0.97/MMBtu during May. Lower natural gas prices in the U.S. Pacific Northwest and western Canada during 2024 so far can be accredited to high natural gas production in the Western Canadian Sedimentary Basin and high natural gas exports into western U.S.

Gas production in western Canada averaged 18.2 billion cubic feet per day (Bcf/d) for the first 10 months of this year, up three percent compared to the same period last year and 11 percent more than the five-year (2019-2023) average for that period. Natural gas exports to the U.S. Pacific Northwest over the same period averaged 3.7 Bcf/d, up 11 percent compared to the five-year average.

Canadian natural gas stocks were 37 percent or 6.5 Bcf/d above the five-year average, as of the end of August. Meanwhile, in the U.S. Pacific region, natural gas stocks have remained above the five-year average so far during 2024. As of the end of October, storage at the Jackson Prairie underground storage facility, the largest storage facility in the region, was more than 90 percent full. Storage sites across the U.S. have been relatively full over the last year, following a mild winter 2023-24. The U.S. ended the last winter season with 2,290 Bcf of gas in storage sites, 39 percent above the previous five-year average. The increase in storage capacity compared to other winters can be attributed to mild weather, reduced consumption and robust natural gas production.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL