Henry Hub Spot Natural Gas Prices Hit Record Low Last Year: EIA

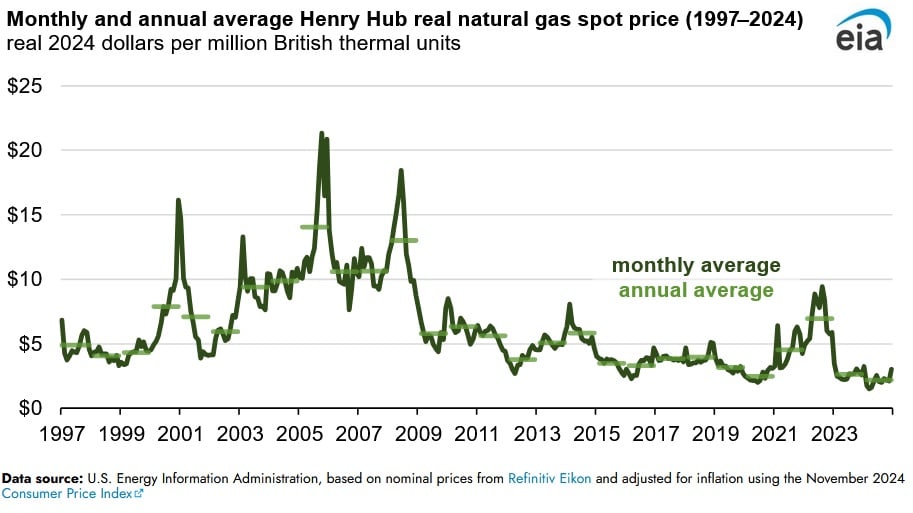

The U.S. benchmark Henry Hub natural gas spot price averaged $2.21 per million British thermal units (MMBtu) during 2024, the lowest yearly average price on record, according to a Jan. 8 report published by the U.S. Energy Information Administration. The average natural gas spot price during 2024 was 16 percent lower than its 2023 average and 68 percent lower than the 2022 average, the lowest two year price decline on record.

During 2024, the average monthly natural gas price reached a high of $3.25/MMBtu during January, and a record low of $1.51/MMBtu during March. The range of monthly prices across 2024 was recorded at $1.74/MMBtu, significantly narrower than the average range of $2.32/MMBtu over the previous five years.

The downward price trend evident in the U.S. natural gas spot price can be attributed to robust natural gas supply fundamentals and constraints in demand for the majority of 2024. January 2024 was an exception, with spot prices hitting a yearly high of $13.49/MMBtu due to a cold snap increasing gas demand for household heating. Firm robust U.S. natural gas production and milder temperatures during February and March led to a downward trend thereafter.

The bearish sentiment evident in the U.S. natural gas market was underpinned by relatively full storage levels. The U.S. ended the winter 2023-24 season with 2,290 billion cubic feet (Bcf) of gas in storage sites, 39 percent above the previous five-year average. The increase in storage capacity during the winter compared to other winters can be attributed to mild weather, reduced consumption and robust natural gas production. According to the National Oceanic and Atmospheric Administration (NOAA) the U.S. experienced its warmest winter on record. Higher temperatures have led to lower gas demand for household consumption and therefore lower demand overall. Moreover, both the commercial and residential sectors used less gas than previous winters and as a result less gas was used from storage sites to fulfil demand. During the winter, around 1,500 Bcf of gas was withdrawn from storage sites compared to 2,000 Bcf during previous winters.

U.S. natural gas demand growth was constrained by marginal changes in the U.S. liquefied natural gas capacity and flat U.S. natural gas net exports. Moreover, injection demand for storage sites was low during the summer period, with the U.S. entering the winter 2024-25 period, with the highest storage level since 2016.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL