Brent Crude Oil Prices Outturn as Forecast During 2024: EIA

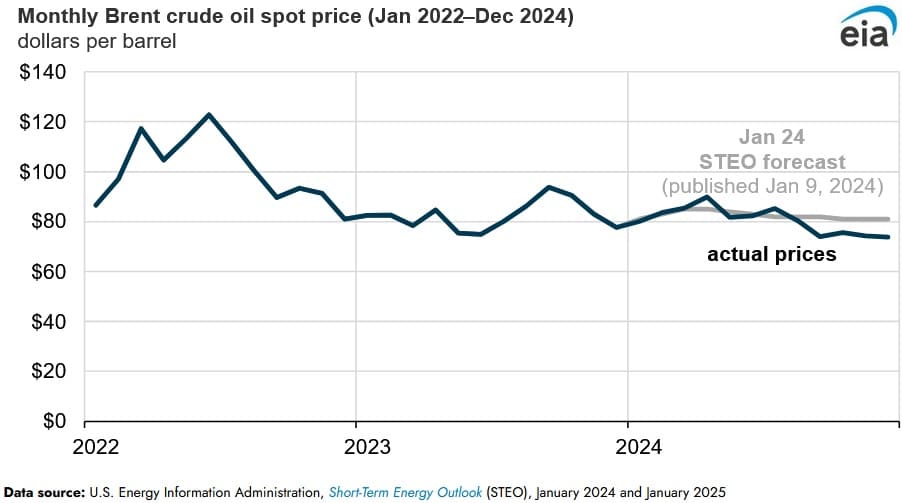

Brent crude oil prices averaged $81 per barrel (b) during 2024, largely similar to the U.S. Energy Information Administration forecast of $82/b made during January 2024, according to a Jan. 17 report published by the agency. During January 2024, the agency forecasted that market supply and demand fundamentals would be largely balanced during the year, and as a result the price forecast was largely the same as the 2023 average Brent price of $82/b. The agency’s projection for balanced markets was on the whole accurate on an annual basis, with global inventories witnessing a slight drawdown of 0.18 million barrels per day during 2024.

Despite the geopolitical uncertainty and risks evident in the global energy market, Brent crude oil prices traded in their narrowest range since 2019, with prices trading in a range of $24/b between $68/b and $93/b. Prices traded within a narrow range based on a number of supply and demand fundamentals. Robust global growth in oil production and dampened demand growth led to weaker prices, whilst voluntary supply reductions among OPEC+ members and heightened geopolitical risks provided prices with underlying support.

OPEC+ production reductions provided Brent crude oil prices underlying support during the first four months of 2024. During April 2024, Brent crude oil prices traded higher than the agency’s projection during January 2024. The spot price of Brent crude oil increased from a monthly average of $78/b during December 2023 to $89/b in April 2024. The spot price of Brent hit a yearly high of $93/b on April 12, 2024, in line with fears that the tensions between Israel and Iran could escalate into a wider conflict and negatively impact global oil supply.

Thereafter, prices largely followed a downward trend for the remainder of 2024, with marginal price corrections driven by OPEC+ announcements in June and September, with regards to delayed production increases. Brent crude oil prices generally declined, following a brief upward trend, particularly during the second half of 2024, amid economic weakness and oil consumption concerns in China. The agency estimates that global oil usage increased by less than 1 million barrels per day (b/d) during 2024, less than the yearly average growth in the decade before the pandemic of 1.5 million b/d.

Disruptions to shipping in the Red Sea were a key feature during 2024, however oil exporters found other routes to markets with supplies being largely unaffected.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL