Strait of Hormuz Remains Critical Supply Route Amid Middle East Conflict: EIA

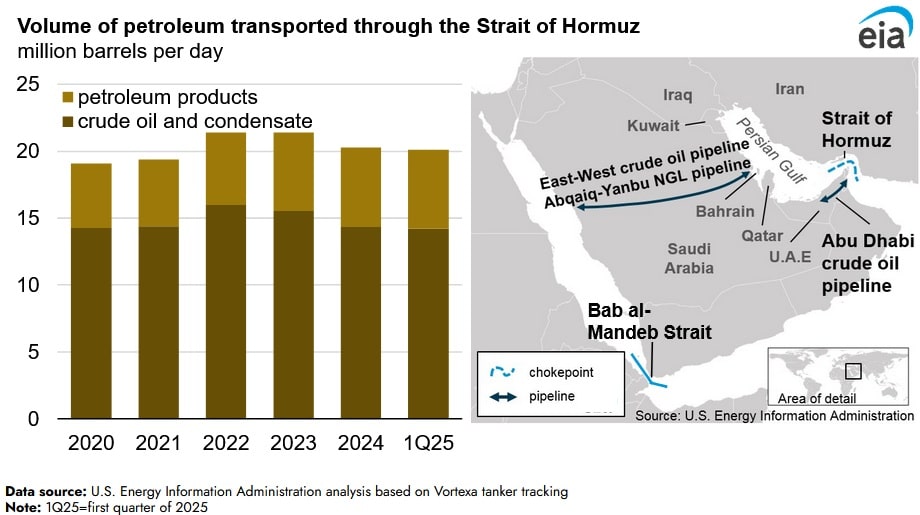

The price of Brent crude oil rose from $69 per barrel (b) on June 12 to $74/b on June 13, according to a June 16 report published by the U.S. Energy Information Administration. The price increase can be attributed to escalating tensions between Israel and Iran are heightening concerns about the security of the oil supply in the Middle East, including possible disruptions to regional supplies, as well as in the Strait of Hormuz, which is critical to global energy trade. During 2024, oil flow via the strait averaged 20 million barrels per day (b/d), or around 20 percent of global petroleum liquids consumption.

The strait connects the Persian Gulf with the Gulf of Oman and the Arabian Sea. The strait is one of the world’s most significant oil chokepoints, with a large amount of oil flow. If the strait is closed, there are only a small number of alternative possibilities to move oil out of the strait.

The majority of volume that transits through the strait has no other alternative of exiting the region, although there are some pipeline alternatives that can avoid the strait. The UAE and Saudi Arabia have some infrastructure that can circumvent the strait; however, the pipelines do not usually function at full capacity, and the agency estimates that around 2.6 million b/d of capacity from the UAE and Saudi pipelines could be accessible to go around the strait in the event of a supply disruption.

During 2024, the agency estimates that 84 percent of the crude oil and condensate and 83 percent of the LNG that moved via the strait went to Asian countries. India, China, South Korea and Japan, were key markets for crude oil moving via the strait to Asia, accounting for a total 69 percent of all Hormuz condensate and crude oil flows during 2024. These markets are most likely to be negatively impacted by supply disruptions at Hormuz.

The U.S. imported around 0.5 million b/d of condensate and crude oil from Persian Gulf countries via the strait during 2024, which accounted for around seven percent of total U.S. condensate and crude oil imports and two percent of U.S. petroleum liquids usage.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL