Refinery Shutdowns Could Lead to Higher Gasoline Prices on The West Coast: EIA

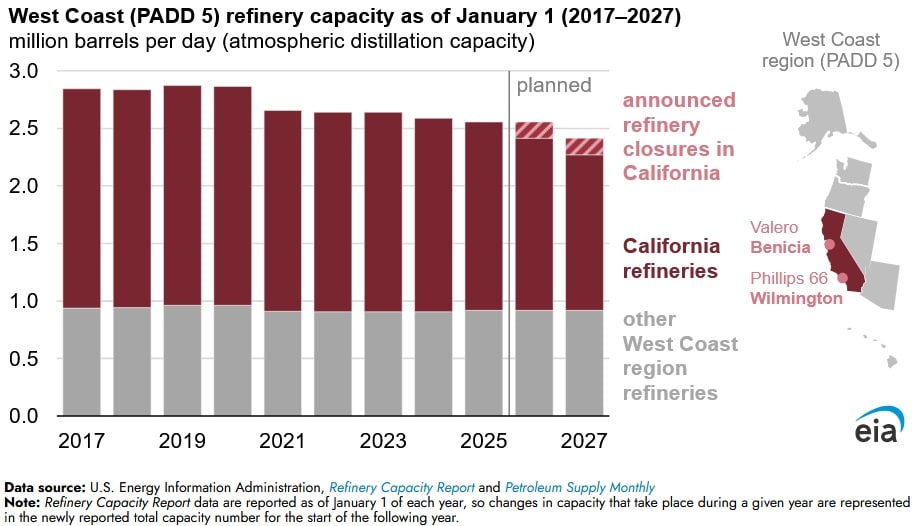

California is projected to lose 17 percent of its oil refinery capacity within the next 12 months due to the planned shutdown of two refineries, according to a July 10 report published by the U.S. Energy Information Administration. If these closures proceed as expected, they could lead to increased fuel price volatility across the West Coast. The agency in their July Short-Term Energy Outlook projects a slight increase in retail gasoline prices on the West Coast next year due to refinery capacity closures, while prices in other regions are expected to decline. The agency projects lower crude oil prices in 2026. This will help offset some of the near-term impact of these closures on retail gasoline prices, since crude oil prices make up about half the cost of gasoline.

Retail regular grade gasoline prices are consistently higher in California compared to any other state in the continental U.S. Retail gasoline prices often exceed the national average by over $1/ per gallon (gal). The high retail gasoline price in California can be attributed to environmental requirements, state taxes and fees, special fuel requirements and isolated petroleum markets. California gasoline prices are also impacted by supply side shortages compared to the rest of the U.S. The majority of the gasoline used in the state is refined within the state, due to a shortage of petroleum infrastructure. California is geographically inaccessible from other U.S. refining centers, due to lack of pipeline interconnections.

In October 2024, Phillips 66 announced plans to shut down its 139,000-barrel-per-day (b/d) Wilmington refinery in the Los Angeles area later this year. In April, Valero filed a notice to cease refining operations at its 145,000-b/d Benicia refinery in the Bay Area by the end of April 2026. These planned closures extend a continuing trend of declining refinery capacity on the West Coast, following the shutdown of petroleum refining at Phillips 66’s Rodeo facility early last year and the closure of Marathon’s Martinez refinery in 2020.

With limited links to other U.S. refining hubs, the West Coast will likely rely heavily on fuel imports from Asia as a primary replacement source. In late May 2025, total gasoline imports to the region surpassed 210,000 barrels per day, marking a record high on a four-week average basis.

Dependence on imported petroleum products brings specific risks to fuel supplies on the West Coast. Since shipments from across the Pacific are slower to respond to market changes, unexpected disruptions can result in short-term price spikes or greater volatility. To address this risk, California enacted a minimum inventory law last year designed to help prevent gasoline shortages.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL