Brent Crude Oil Price Forecast Increases After OPEC+ Extends Production Cuts: EIA

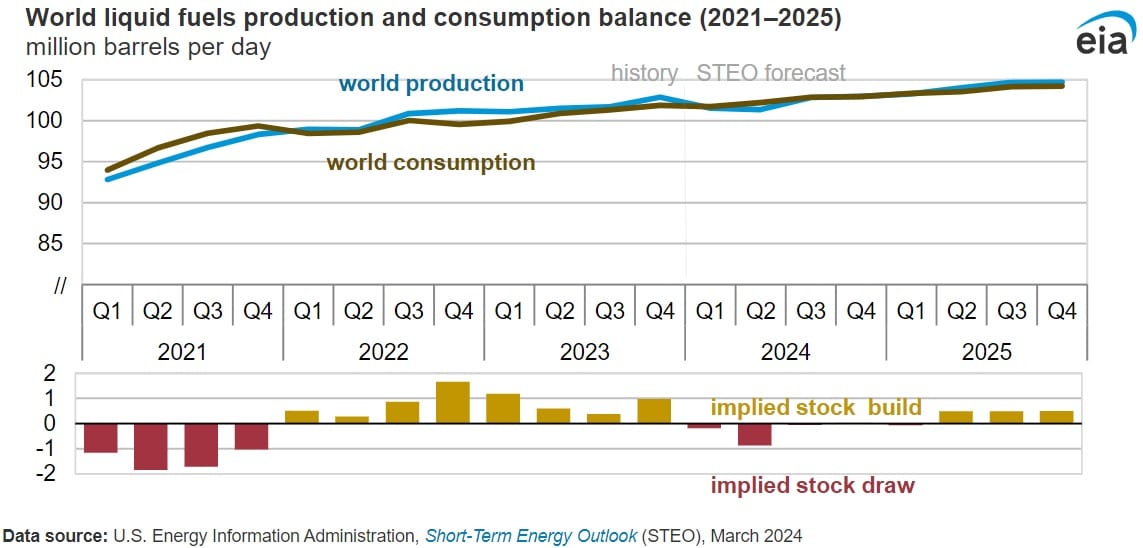

Brent crude oil and petroleum product prices are projected to increase for the remainder of 2024, according to a March 21 report published by the U.S. Energy Information Administration. The projected price increase can be attributed to the announcement that OPEC+ will extend the current voluntary production cuts through the second quarter of 2024. The agency is now projecting lower global oil production than global oil consumption through the first half of 2024.

Accordingly, world petroleum stocks are expected to be withdrawn and this is expected to provide oil and petroleum products with underlying price support.

The agency is now forecasting global oil production to be 101.3 million barrels per day (b/d) during 2Q 2024, following OPEC+ extending their production cuts. As a result, world oil production is expected to be 0.9 million b/d less than the agency’s forecast of 102.2 million b/d for global oil consumption. The agency had previously incorporated potential OPEC+ production cuts into their assumptions, however the announcement made earlier in March with regards to production cuts was larger than previously anticipated. The most recent announcement includes a voluntary production reduction from Russia, which was not previously considered.

OPEC+ production cuts include both officially stated production targets and supplementary voluntary cuts pledged by specific OPEC+ countries. The agency’s previous forecast did not take into consideration Russia’s added new voluntary production reductions and the fact that all members will continue with their voluntary cuts which were expected to expire during 1Q 2024 into 2Q 2024.

The reason prices are expected to increase is because inventories are projected to be withdrawn at a faster pace than initially projected to meet domestic demand, which puts upward pressure on prices. The agency is projecting Brent crude oil prices to average $88 per barrel in 2Q 2024, up $4 per barrel than their previous month’s forecast. Thereafter, prices are expected to remain relatively flat for the remainder of the year, before declining to $82 per barrel by the end of 2025, in line with OPEC+ production cuts projected to expire and therefore production increases.

A number of uncertainties could impact the price forecasts provided by the agency. The current geopolitical environment continues to impact shipping routes and could lead to higher prices going forward. Moreover, compliance by OPEC+ members with regards to production cuts and forecasts of global economic growth and therefore the impact on global oil consumption provides additional price unpredictability.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL