Brent Crude Prices to Fall in 2025-2026 Amid Strong Production Growth, Slower Demand: EIA

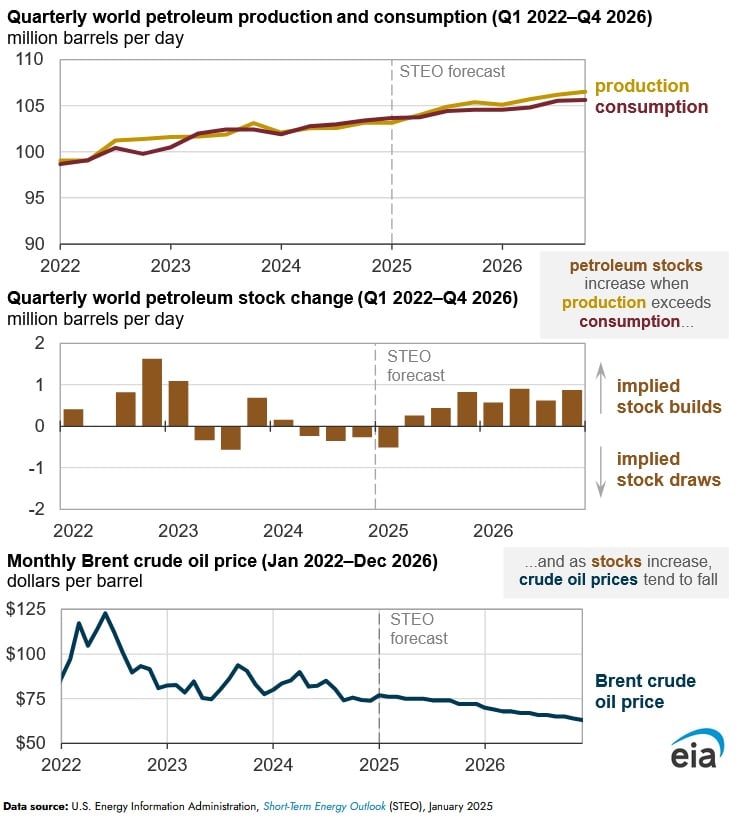

Brent crude oil prices are expected to decline from an average of $81 per barrel (b) during 2024 to $74/b in 2025 and $66/b in 2026, according to an Jan. 21 report published by the U.S. Energy Information Administration. The agency’s price decline expectations can be attributed to slower demand growth and robust global growth in production of petroleum and other liquids. Voluntary production reductions from OPEC+ members and heightened geopolitical risks will continue to provide prices with underlying support over the next two years.

Brent crude oil prices averaged $81/b during 2024, largely similar to the agency’s forecast of $82/b made during January 2024. During January 2024, the agency forecasted that market supply and demand fundamentals would be largely balanced during the year, and as a result the price forecast was largely the same as the 2023 average Brent price of $82/b. The agency’s projection for balanced markets was on the whole accurate on an annual basis, with global inventories witnessing a slight drawdown of 0.18 million barrels per day during 2024.

The agency projects prices to average $66/b during 2026 on the back of growing production in countries outside OPEC+ and demand growth that is lower than the pre-coronavirus pandemic average. Production is expected to outpace consumption and lead to higher global oil inventories. Moreover, the agency expects OPEC+ members to restrict production during 2025 and 2026, in order to provide prices with support and prevent them from declining further. The lower prices are expected to reduce drilling activity and investment in U.S. crude oil production and other liquids, and in turn lead to smaller production increase during 2026.

Oil supply and demand fundamentals continue to remain uncertain going into the next two years, and any significant changes to fundamentals will impact the agency’s Brent crude oil forecast. As a result, the forecast by the agency hinges upon a number of assumptions, which could change over the next two years, in accordance with both the economic and political environment. For example, OPEC+ members could alter their production reduction policy, if the group loses significant market share to other countries.

Price forecasts by the agency could be impacted by the current geopolitical environment, since the geopolitical uncertainties have the potential to negatively impact supply from several OPEC+ members. As it stands, the conflict in the Middle East has not interrupted oil supplies, however continued tensions could pose supply risks over the next two years.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL