California Fuel Market Faces Challenges Following New Regulations and Refinery Closure: EIA

The U.S. Energy Information Administration issued a report on Dec. 9 discussing the ongoing challenges in California’s fuel market following the enactment of a new law granting regulators authority over petroleum inventory levels, along with the announced closure of Phillips 66’s Wilmington refinery.

California Governor Gavin Newsom signed a bill into law on Oct. 14 allowing the state’s regulators to establish and alter minimum petroleum product stock levels for refiners in California, in order to deal with the state’s fuel price volatility. The new law permits the California Energy Commission to develop and enact minimum storage level requirements for refined transportation fuels for each refiner in the state has been approved. Moreover, refiner Phillips 66 announced on Oct. 16 plans to shut down its Washington refinery by Dec. 31, 2025 due to concerns around the long-term profitability of the refinery.

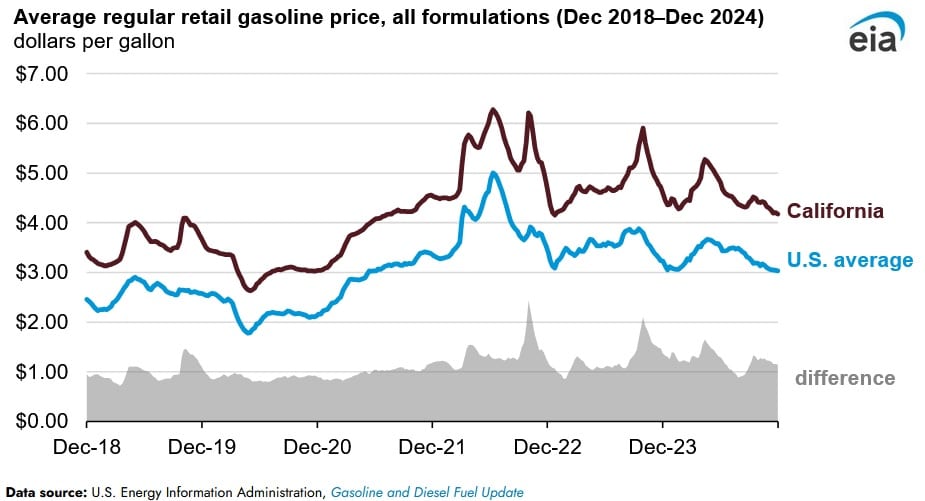

The law permits regulators to alter minimum storage volumes based on seasonal and regional market conditions, storage capacity and refinery size. It also permits the commission to consider the utilization of a tradeable mechanism for compliance with the minimum stock regulation, which California has used previously for programs like the Low Carbon Fuel Standard. The bill aims to dampen gasoline price volatility. Retail gasoline prices in California usually exceed $1 per gallon and are one of the highest compared to other states in the U.S. The high gasoline price in the state can be attributed to higher crude oil expenditures, high refining expenses on the West Coast and lower inventory levels compared to other states in the U.S.

Refiner Phillips 66 announced plans to shut down refining activity at its 139,000 barrels per day Wilmington refinery during the last quarter of 2025. The refiner indicated the facility could use its existing petroleum infrastructure to import fuels. Phillips 66 also completed the conversion of its Rodeo refinery into a renewable diesel production facility that no longer processes crude oil. Lower crack spreads in the second half of 2024 have been an issue for refiners across the U.S. and have been a key factor behind the Willington refiner’s shutdown decision.

Global refinery margins for petroleum refiners are declining, which has led to lower financial profitability from selling petroleum products and refining crude oil. Refinery margins have declined due to weak demand for petroleum products. Petroleum product consumption has also been low in Europe and China due to weak economic growth. Moreover, increasing use of biofuels, electric vehicles and liquefied natural gas utilization in trucking and transportation is gradually reducing petroleum fuel usage across the majority of Europe and Asia.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL