Crude Oil Market Supply Tightness Supported Higher Oil Prices in 2021: EIA

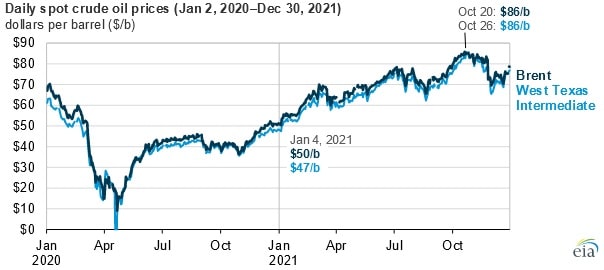

Brent spot prices began at $50 per barrel in January 2021 and climbed to a high of $86 per barrel in October before falling in the final weeks of the year, according to a Jan. 4 report from the U.S. Energy Information Administration (EIA) on crude oil prices recovery last year. The agency highlighted that crude oil prices rose as global petroleum demand grew faster than supply amid increasing COVID-19 vaccination rates, easing pandemic-related restrictions, and a growing economy.

The limited growth in crude oil production was strategically driven by OPEC+ countries in late 2020 to support higher crude oil prices amid the weak demand. There has been a decline in investment crude oil production since mid-2020 as companies sought to retrench capital spending under pressure from low prices, low returns to shareholders, and lack of interest by investors. The COVID-19 pandemic further disrupted operations, forcing shutdowns and underinvestment that reduced supply. Also, the supply chain bottlenecks have delayed a swift pickup in production. All these activities have resulted in supply tightness giving a boost to crude oil prices.

EIA’s Short-Term Energy Outlook released in December estimates that U.S. crude oil production in 2021 declined by 0.1 million barrels per day from 2020 and by 1.1 million barrels per day from 2019 levels. The weather-caused operational disruptions and an overall weakening in investment among U.S. upstream companies are the major reason behind the production drop since 2020.

The global supply crunch and growing demand has constantly compelled countries to release petroleum and liquid fuels inventory, further strengthening the crude oil prices. In Feb. 2021, the biggest inventory withdraws happened when Saudi Arabia imposed a production cut of 1.0 million barrels per day and the U.S. production was interrupted under severe cold weather resulting in a decline of 1.3 million barrels per day of oil production.

According to EIA estimates, petroleum inventories decreased by 469 million barrels globally in 2021, marking the largest withdrawal in a single year since 2007.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL