Energy Commodity Prices Impacted by Russian Invasion of Ukraine: EIA

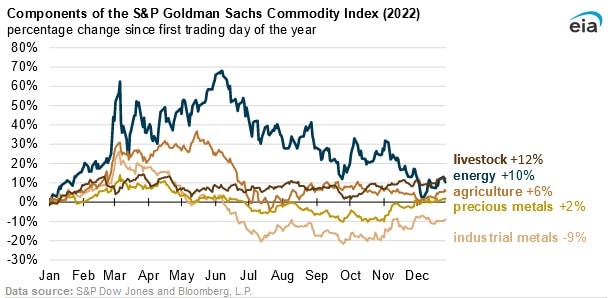

The energy component of the S&P Goldman Sachs Commodity Index, or GSCI, increased 10 percent at the end of 2022 compared to the first trading day of that year, according to a Jan. 3 report from the U.S. Energy Information Administration. The increase in the index can be largely attributed to the Russian invasion of Ukraine in February 2022. The invasion impacted Russian pipeline gas flows towards Europe and led the European market to import more liquefied natural gas.

The greater reliance of Europe on LNG to meet domestic demand has in turn affected energy trade dynamics across the globe, since gas which was usually destined towards Asia has now taken berth at European terminals, due to the price incentive offered by the European market.

The GSCI is a weighted average of 24 commodity contracts structured into five sub-indexes, which consist of energy, industrial metals, agriculture, livestock and precious metals. The weight allocated to each commodity indicates its importance to the global economy as assessed by its production volume and liquidity.

The energy sub index is predominantly determined by two major crude oil benchmarks : West Texas Intermediate, or WTI, and Brent Crude Oil. These price indexes account for 70 percent of the energy sub index and therefore any large price movements in the oil markets tend to have a significant impact on the energy sub index. Brent crude oil prices were significantly impacted by the Russian Invasion of Ukraine. Moreover, the ensuing sanctions had a bullish price impact on global oil prices. The average WTI price for June 2022 averaged $114 per barrel in June 2022, the highest level in real terms since September 2014. WTI prices have since declined, in line with global recession fears and its consequent impact on oil demand. As it stands currently, the WTI crude oil price rose by 3% on the first trading day of 2023, compared to the first trading day of 2022.

Three petroleum based products (RBOB, ULSD and gasoil) account for 24 percent of the S&P GSCI energy sub-index, whilst natural gas accounts for 6 percent. RBOB rose by 5 percent on the first trading day of 2023, compared to the first trading day of 2022, whilst ULSD and gasoil increased by 41 percent and 36 percent respectively. Natural gas prices increased by 20 percent for the subsequent period.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL