Enhanced Well Productivity Lowers Costs for U.S. Oil Producers: EIA

Increasing well productivity is assisting 34 publicly traded U.S. oil exploration and production companies lower production expenditures on a per barrel basis and making cash reserves available for uses such as share repurchases and dividends, according to a Dec. 11 report published by the U.S. Energy Information Administration.

During the January to August 2024 period, U.S. crude oil production averaged a record high of 13.1 million barrels per day (b/d). The increase in crude oil production can largely be attributed to enhanced efficiency of new wells. Improvements in horizontal drilling and hydraulic fracturing technologies have enhanced well yield, allowing producers to extract higher volumes of crude oil from new wells, while at the same time continuing output from legacy wells. Historically, the number of new wells coming online was a key determinant of whether crude oil production increases or decreases, but now well efficiency is also a key component. The increase in U.S. crude oil production is due to both an increase of new well production and higher sustained legacy well production. The agency reports that the share of legacy production, which can be defined as crude oil withdrawn after the preliminary 12 months, has been constant since 2021, while output from new wells has consistently risen.

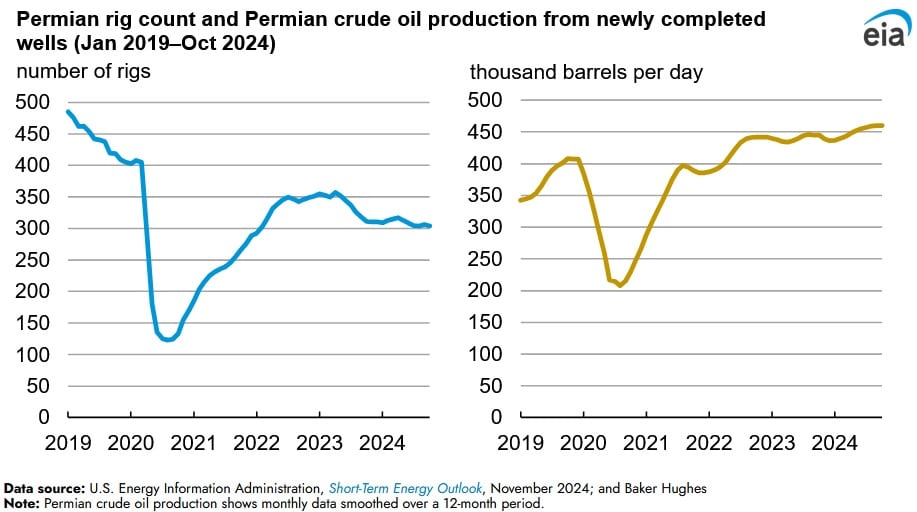

In the Permian region, production has increased despite a decline in the number of active rigs since 2014. Historically, the number of active oil rigs were a key determinant of crude oil. However, more recently U.S. crude oil output has risen due to technological improvements and efficiency advantages.

The agency examines the second quarter 2024 financial results and reports that recent production and spending data indicate these companies are increasing oil production output, whilst at the same time controlling expenditures. Crude oil production in the second quarter of 2024 was the highest in five years and recorded at 3.9 million b/d. Upstream capital cost per barrel of oil equivalent (BOE) produced has averaged around $21/BOE in real terms since mid-2022, compared to $32/BOE in 2019. During the same period, crude oil output by the exploration and production firms rose by 21 percent.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL