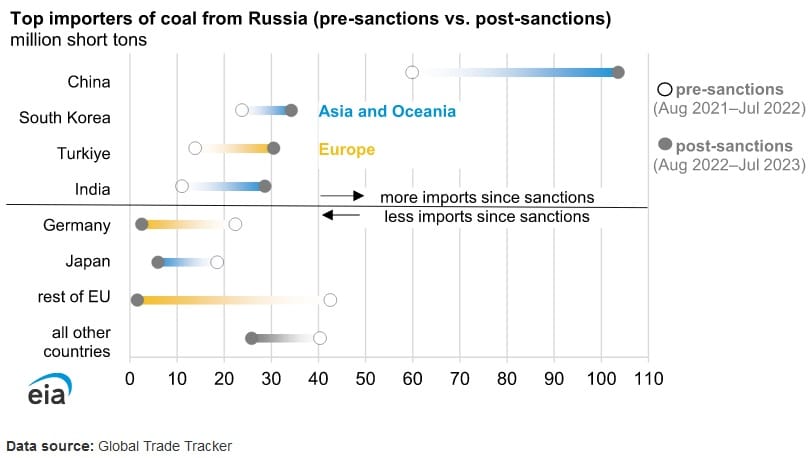

Four Asian Countries Account for 80 Percent of Russian Coal Imports: EIA

Russia’s coal trading dynamics have been significantly impacted by the country’s invasion of Ukraine and the consequent sanctions imposed by some nations. Russian coal imports to China, Turkiye, South Korea and India have increased significantly, while Russian coal imports to European countries declined following the sanctions, according to a report issued on Jan. 22 by the U.S. Energy Information Administration. This trade shift correlates with increased coal exports from the U.S. to Europe and EU sanctions that took effect in August 2022. The U.S., Japan, Australia, and other countries issued sanctions during this same time period after Russia’s full-scale invasion.

The Russian invasion of Ukraine has led to an alteration in trading dynamics, with European countries importing more coal from the U.S. and shifting away from Russia. The Russian invasion of Ukraine has contributed to higher demand for U.S. coal and led to a structural shift in the market, which has impacted trading dynamics for a number of energy sources. Russian pipelined gas to Europe has significantly declined since the Russian invasion of Ukraine. The EU is relying on other fuel sources for electricity generation, with European gas prices trading at record prices and therefore an expensive input fuel. As a result, European demand for U.S. coal has increased.

China, India, Turkiye and South Korea accounted for over 80 percent of total Russian coal exports from August 2022 to July 2023, compared to 47 percent from August 2021 to July 2022. Meanwhile, coal imports from Russia by European countries declined 57 percent between these two periods.

Historically, China and South Korea have been the top two importers of Russian coal, and continued importing vast volumes of Russian coal, following the invasion of Ukraine, witnessing a 73 and 44 percent increase, respectively, from August 2022 to July 2023, compared to the preceding 12-month period. On the other hand, Germany and Japan, which were the third and fourth largest importers, banned Russian coal imports. The ban by some countries led Russia to diversify their coal exports and accordingly Turkish and Indian coal imports rose by 120 percent and 159 percent, respectively, over the same period.

Since August 2023, China, India, Turkiye and South Korea continue to import vast volumes of Russian coal and still account for over 80 percent of total Russian coal exports.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL