Gasoline Crack Spread Decreases Amid Low U.S. Demand: EIA

Gasoline production has become less profitable due to low demand and the shift to winter-grade gasoline, according to a Nov. 1 report from the U.S. Energy Information Administration. As a result, the difference between gasoline blendstock and crude oil prices dropped to multiyear lows in October 2023.

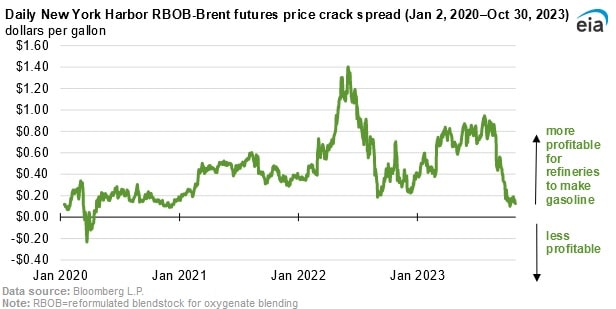

The difference in price between a wholesale petroleum product and crude oil – called “crack spread” – serves as an indicator of refining profits. The reformulated blendstock for oxygenate blending (RBOB)- Brent crack spread averaged 16 cents/gallon during October, the lowest monthly average since December 2020, according to the agency. The crack spread reached a high of 94 cents/gallon on July 27 and has followed a downward trend since August, ending the month at 70 cents/gallon. During September the crack spread fell further and ended the month at 17 cents/gallon.

A key mover of the spread has been weak gasoline demand, which has led to high U.S. gasoline inventories. U.S. gasoline inventories as of Oct. 13 were recorded at 223.3 million barrels, up 4 percent compared to the start of September. U.S. gasoline consumption has been negatively impacted by higher gasoline prices, high inflation reducing consumer spending power and enhanced efficiency of vehicles. As it stands, U.S. gasoline consumption has been lower compared to lows in 2022, when demand was significantly reduced due to high gasoline prices and inflation, and 2020, when the COVID-19 pandemic considerably lowered demand. Lower gasoline demand and higher inventories were projected by the agency earlier in the year, with the agency forecasting consumption to decline by 0.3 million barrels per day in 2023, compared to 2022.

The RBOB-Brent crack spread has also declined, in line with the shift to winter grade gasoline. Moreover, higher than average U.S. gasoline production has also contributed to the reduction in the RBOB-Brent crack spread. Refineries have persisted with production at an average rate, despite low crack spreads, because other products they produce have continued to be profitable, despite lower demand.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL