Global Carbon Allowance Prices Rose by More than 40 Percent in 2021: EIA

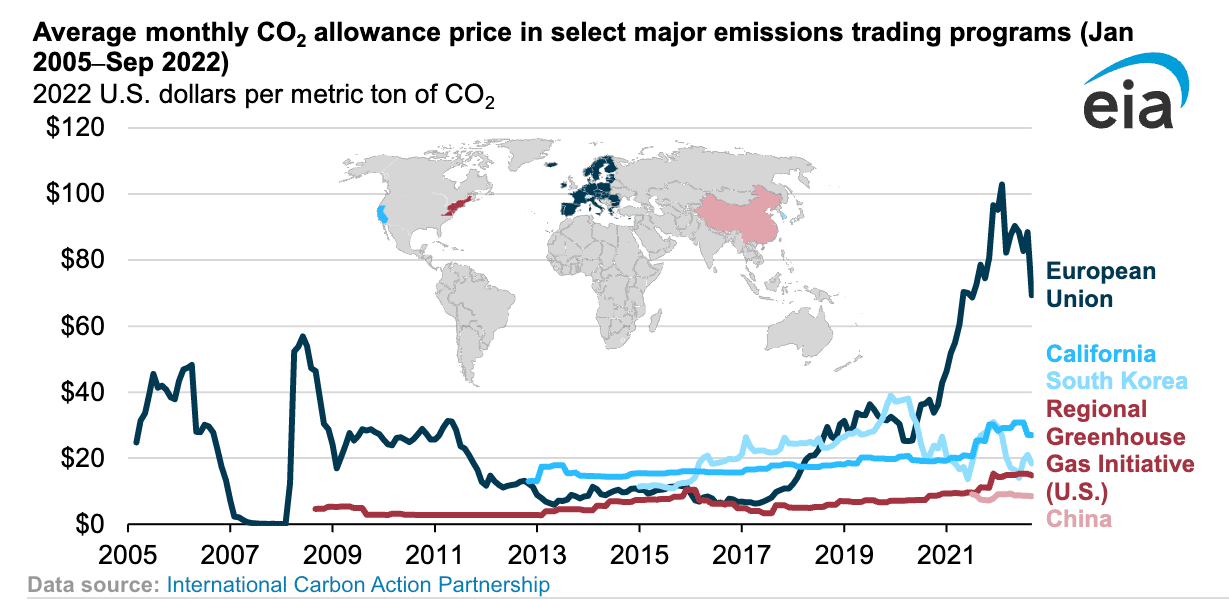

The average allowance price for carbon dioxide emissions increased in four of the world’s five largest carbon emissions trading platforms between Jan. 2021 and Jan. 2022, according to a Dec. 13 report from the U.S. Energy Information Administration. Emission trading systems are used by governments to regulate carbon dioxide emissions. The four trading systems that witnessed the price increase were : European Union’s Emissions Trading System, or EU-ETS, Korea Emissions Trading System, or KETS, California’s Cap and Trade Program, and Regional Greenhouse Gas Initiative, or RGGI. The report, based on data from the International Carbon Action Partnership, shows that the average allowance prices for carbon emissions rose by over 40 percent in these trading systems during the aforementioned period.

China’s National Emissions Trading System, or China-ETS, did not experience an increase in allowance prices during 2021 and this can be partially attributed to the fact that the emissions trading system is comparatively new and came online in 2021. The Chinese government introduced the China-ETS, in order to reduce carbon dioxide emissions, resulting from the usage of coal fired power stations. As part of the system, regulation entities like power generators and industrial corporations can buy and sell carbon dioxide emission allowances, which authorises them to release a allocated volume of a greenhouse gas.

The emissions trading systems that witnessed a price increase during 2021, entered new phases of implementation, which imposed tighter regulations on emissions and lowered the emissions cap and therefore led to bullish price impetus for allowances.

The most notable allowance price increase occurred in the EU-ETS. The monthly average allowance price for the EU-ETS more than doubled from $46 per ton to $95 per ton, between January 2021 and January 2022. Allowances prices in the California’s program rose at a slower rate of 46 percent, increasing from $19 per ton to $28 per ton, whilst prices in the KETS rose by 43 percent, from $21 per ton to $29 per ton. Meanwhile, allowance prices in the RGGI saw a 54 percent increase, from $9 per ton to $14 per ton.

The easing of COVID-19 related lockdown restrictions impacted all of these emission trading systems. Many countries experienced economic growth during 2021 and this increased the demand for energy powered by fossil fuels. In turn, this led to higher demand for carbon allowances and therefore higher prices. Elevated uncertainty in global energy markets, following the Russian invasion of Ukraine, has led to differences in average monthly allowance price trends across emissions trading systems between January and September 2022.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL