Global Natural Gas Supply-Demand Balances Could Tighten During Winter 2024-25: EIA

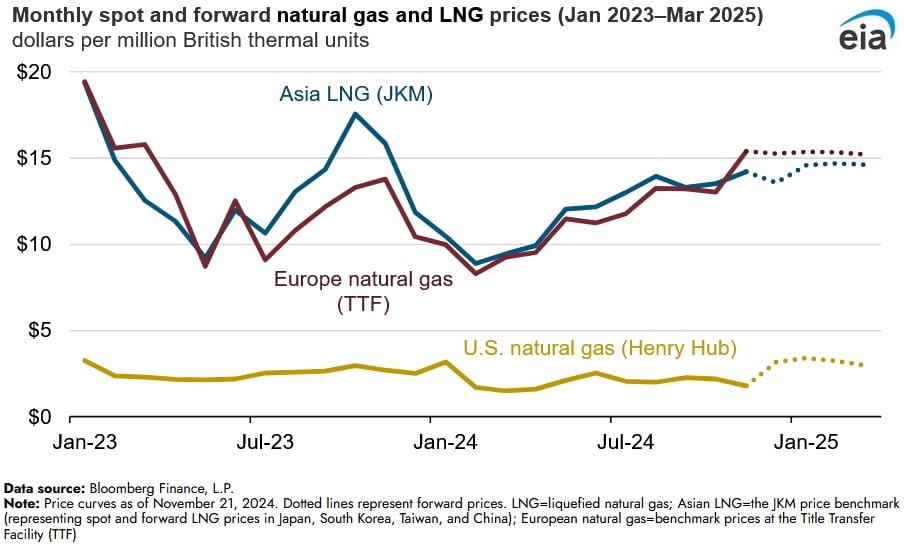

Global gas markets could witness tighter supply-demand fundamentals during winter 2024-25, according to a Nov. 25 report published by the U.S. Energy Information Administration. The previous two winters in the Northern Hemisphere have witnessed above seasonal normal temperatures, leading to lower demand and in turn relatively higher storage capacity. If the temperature during winter 2024-25 remains above seasonal normal, then the agency expects the global supply picture to be comfortable and prices to be similar to the past two winters. In contrast, if Europe and Asia experience below seasonal normal temperatures for a prolonged period during the winter, then the global supply-demand balance could tighten and lead to higher natural gas prices and possible price spikes.

Two consecutive mild winters during 2022-23 and 2023-24 coupled with lower gas consumption due to both government policies and higher renewable generation led to record high end of heating season storage stocks in both 2023 and 2024. Gas storage sites were recorded at 59 percent full across Europe, as of April 1, 2024. This was the highest level on record for the end of the heating season. The Russian invasion of Ukraine in February 2022 led to a reduction in the amount of Russian pipelined gas coming towards Europe. In order to ensure gas supply in the domestic market is sufficient to fulfil domestic demand, European governments, in coordination, enacted demand reduction policies and measures. These policies directed a minimum 15 percent reduction in natural gas usage from August 2022 to March 2023. These policies were further extended up until March 2025.

The global supply and demand outlook could be impacted by a number of factors during the winter period such as; weather, operational issues, geopolitical tensions, LNG supply growth, wind generation, shipping rates among others. The key factor determining the fundamental supply and demand outlook of global gas markets will be weather, due to the impact of weather related higher demand on the flow of Liquified Natural Gas.

Below seasonal normal temperatures would lead to a competition between the European and Asian market for LNG. Natural gas storage inventories in the EU as of Oct. 31, 2024, were 95 percent full. As it stands, storage sites are now 88 percent full, the fast withdrawal rate in recent weeks has led the Title Transfer Facility gas price to rise relative to the JKM price and as a result there has been a diversion of LNG cargoes away from the Asian market towards the European.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL