International Demand and Low U.S. Prices Drive Growth in U.S. Fuel Ethanol Exports: EIA

U.S. fuel ethanol exports are projected to reach a record high during 2024, according to an Nov. 6 report published by the U.S. Energy Information Administration. The growth in U.S. fuel ethanol exports can be attributed to relatively lower U.S. fuel ethanol prices, high U.S. fuel ethanol production and robust demand in countries with biofuel blending mandates.

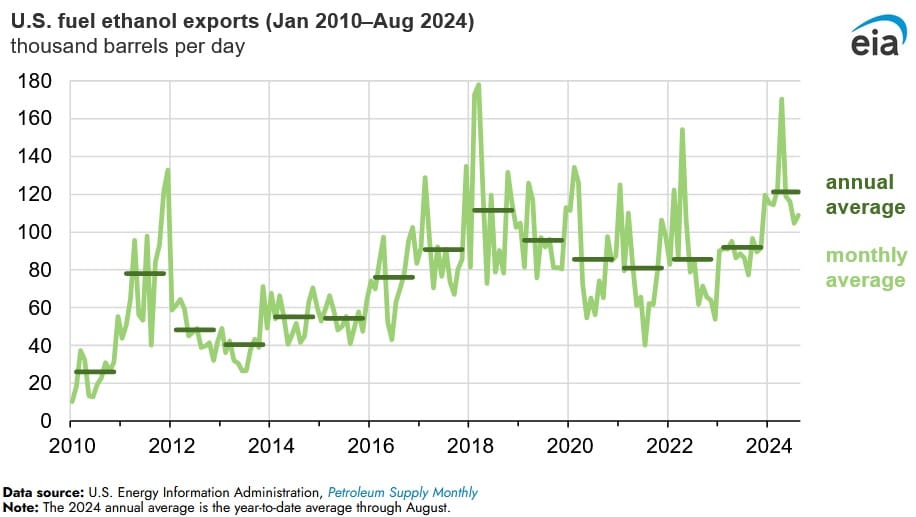

U.S. fuel ethanol exports have averaged 121,000 barrels per day (b/d) during the January to August period of this year, a record high for a similar period during any previous year. Exports have surpassed 100,000 b/d for every month of the year so far. U.S. fuel ethanol exports to Canada, India, Colombia and the UK account for over 60 percent of the growth from 2023 to 2024. Fuel ethanol accounts for most of U.S. biofuels production capacity.

U.S. fuel ethanol exports to India have witnessed the largest increase during the January to August 2024 period, due to India’s fuel ethanol blend goals, under its Ethanol Blended Petrol Program. U.S. fuel ethanol exports to the U.K. have also increased significantly. Fuel ethanol usage has been rising in the UK since the UK government approved an E10 standard in September 2021. Moreover, fuel ethanol assists in fulfilling the growing renewable fuel goals in the UK’s Renewable Transport Fuel Obligation program. Canada has also imported more fuel ethanol from the U.S., and remains the U.S.’s top destination for exports. Regional blend mandates and programs are growing in Canada, and this continues to drive their import demand from the U.S. Colombian demand for U.S. fuel ethanol is mostly attributed to the reintroduction of an E10 mandate and lower domestic ethanol production.

U.S. fuel ethanol prices have been relatively low during 2024 and this has driven demand for the commodity from the U.S. The yearly average fuel ethanol price during 2024 on the U.S. Gulf Coast, from where the majority of U.S. fuel ethanol exports leaves, has declined by around 25 percent from 2023 and is at its lowest level since 2020.

Fuel ethanol production reached an all-time high during July and is expected to reach its highest yearly volume since 2018 as a result of enlarged production capability and low input prices. U.S. fuel ethanol production capacity rose in 2023 and continues to expand during 2024. Low input prices have allowed fuel ethanol producers to sustain high profit margins and utilization levels.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL