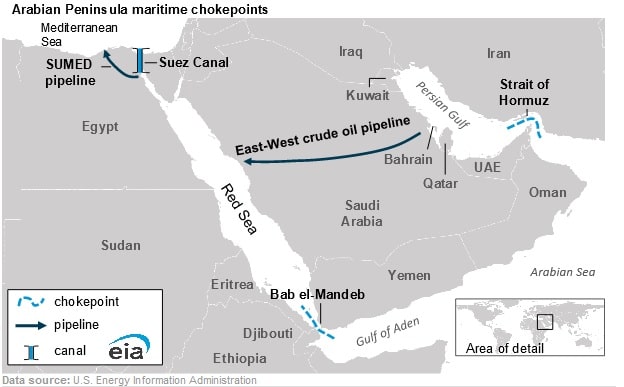

Large Volumes of Oil and Natural Gas Flow Via Red Sea Checkpoints

During the first half of this year, northbound crude oil flows through the Suez Canal and the SUMED pipeline rose by over 60 percent from 2020, due to an uptick in demand from Europe and the U.S. following the COVID-19 pandemic induced lows, according to a Dec. 4 report from the U.S. Energy Information Administration. The SUMED pipeline, the Bab el-Mandeb Strait and the Suez Canal are vital pathways for Persian Gulf oil and natural gas shipments to Europe and North America.

Oil deliveries through these routes consisted of around 12 percent of total seaborne traded oil during the first six months of 2023, and liquified natural gas (LNG) deliveries accounted for around 8 percent of global LNG trade.

Moreover, a change in trading dynamics occurred following the Russian invasion of Ukraine during 2022, and the consequent Western sanctions on Russian oil. The sanctions on Russian oil led Europe to increase oil imports from the Middle East through the Suez Canal and SUMED pipeline and reduce their reliance on Russian oil.

Western sanctions on Russian oil exports also led to higher southbound shipments through the Suez Canal during 2023 compared to 2021. Oil exports from Russia consisted of 74 percent of Suez southbound oil transportation during the first six months of 2023, up from around 30 percent during 2021. Majority of the oil exports from Russia were intended for the Chinese and Indian market. Moreover, Saudi Arabia and the United Arab Emirates increased imports of Russian refined oil products during 2022 and first six months of 2023.

LNG shipments via the Suez Canal in both directions increased to an amalgamated peak in 2021 and 2022 of 4.5 billion cubic feet per day, or bcf/d. However, during the first six months of 2023 LNG flows have declined to 4.1 bcf/d. During 2022 and the first half of 2023, southbound LNG volumes through the Suez Canal declined as both U.S. and Egyptian LNG exporters favoured the European market over Asian due the price premium the region offered, amid reduced Russian pipeline gas and the structural shift in the global gas market following the Russian invasion of Ukraine. Northbound flows rose in 2022, due to Qatar sending significant volumes to Europe in 2022, to compensate for a reduction in Russian volumes.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL