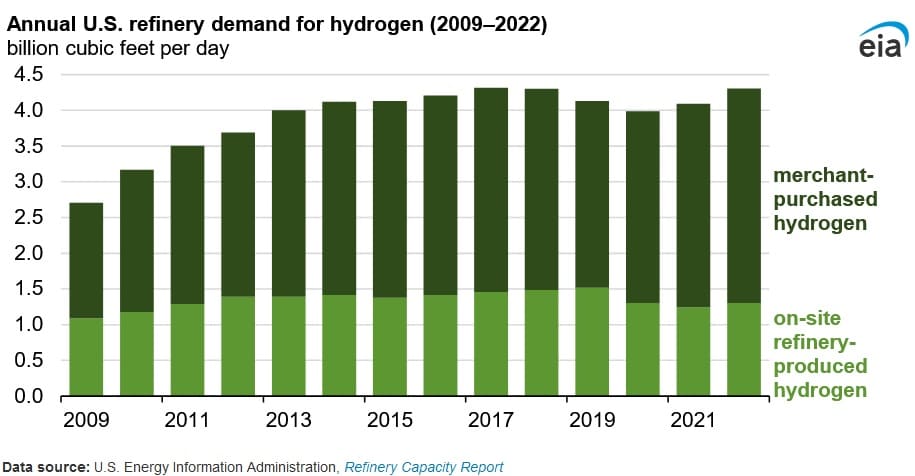

Merchant Suppliers Met 70 Percent of U.S. Refinery Hydrogen Demand in 2022: EIA

U.S. West Coast refineries are utilizing more hydrogen from merchant suppliers than from their own production, according to a May 7 report published by the U.S. Energy Information Administration. Merchant suppliers accounted for over 62 percent of the hydrogen utilized by West Coast refiners during 2022. The inclination towards higher utilization of purchased hydrogen is apparent across the U.S., however on a lower scale. Merchant suppliers accounted for 63 percent of the U.S. refinery hydrogen demand in 2019 and 70 percent in 2022.

Hydrogen procured by refineries in the West Coast region during the 2012 to 2022 period rose by 29 percent to 550 million cubic feet per day (MMcf/d), while refinery produced hydrogen from gas declined by 20 percent to around 330 MMcf/d.

Hydrogen demand across the U.S. refining industry rose considerably during 2006 to 2010, as a result of ultra-low sulphur diesel being phased in and replacing all on road diesel. Refiners generally satisfy additional hydrogen demand by either producing it on site via steam methane reforming of natural gas or by procuring hydrogen from merchant suppliers.

Merchant-supplied hydrogen for petroleum products and renewable diesel production comes from industrial processes where it is a by-product. Meanwhile, industrial natural gas producers use steam methane reformers to convert natural gas feedstock into hydrogen. By-product hydrogen can be attained from a chemical plant or other asset where hydrogen is not the principal product. According to a study done by the agency in 2018, by-product hydrogen accounted for at least 50 percent of all hydrogen purchased by U.S. refineries and at least 30 percent of all hydrogen that refineries need that is not produced from by-product reforming.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL