Michigan Summer Outlook Projects Decline in Home Energy Demand

Energy consumers in Michigan can anticipate more affordable prices in 2023 summer compared to 2022, according to a June 7 report released by the Michigan Public Service Commission. The report projects a decrease of 86 cents per gallon in average seasonal gasoline prices. Although there may be a slight increase in electricity costs, this will be balanced out by a reduction in residential home energy demand. There is a projected overall increase of 2.2 percent in natural gas demand, primarily driven by the shift of electric providers from coal to natural gas for power generation purposes. This transition is anticipated to contribute to the rise in natural gas consumption across the state.

Following are the key findings from the energy outlook report for Michigan energy sectors.

- Midwest gasoline prices: $3.19/gallon in 2023, $2.96/gallon in 2024

- WTI crude oil forecast: $73.62/bbl in 2023, $69.47/bbl in 2024

- Michigan electricity demand: -1.3 percent for 2023, Industrial Sector +1.6 percent

- Michigan industrial growth may boost distillate demand

- Natural gas consumption: +2.2 percent, led by electric power generation

Michigan is part of two regional transmission organizations. Most of the state is within the Midcontinent Independent System Operator and the southwest section of the lower peninsula is in the PJM Interconnection region. Michigan load serving entities also participate in their respective grid operator’s resource adequacy constructs and capacity markets. MISO is also projected to have adequate capacity to meet resource adequacy requirements at the regional, sub-regional, and zonal levels for the fall, winter, and spring seasons. PJM also cleared adequate resources in its auction for planning year 2023/2024 held in June 2022 to meet resource adequacy standards.

The report includes energy supply and demand expectations for summer 2023:

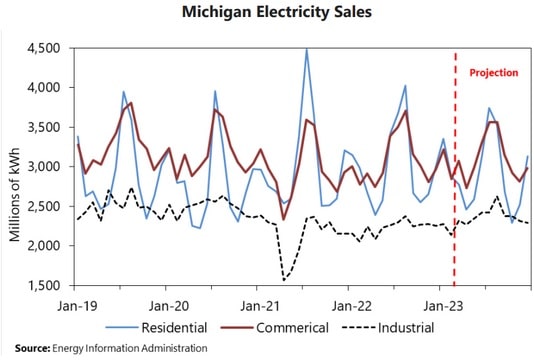

Electricity: The Midcontinent Independent System Operator’s first auction for planning year 2023/2024 using the seasonal resource adequacy construct resulted in clearing prices of $10/megawatt-day for Zones 7, 2, and 1, with capacities of 21,380.6 megawatts, 14,112.6 megawatts, and 19,514.7 megawatts respectively. Total electric sales expected to decrease by 1.3 percent, primarily driven by a decline in residential and commercial demand. Industrial demand is projected to grow by 1.6 percent. Residential electric rates have slightly increased.

Natural Gas: Natural gas demand is anticipated to rise by 2.2 percent, driven by increased demand from the electric generation sector. Prices are expected to decline by 55 percent compared to the previous year. Natural gas storage levels are projected to increase by 3.5 percent to touch 476 Bcf in 2023.

Gasoline: Average gasoline prices have decreased, with a state-wide average of $3.53 per gallon on June 5, 2023. Midwest gasoline prices are forecasted to average $3.30 per gallon during the driving season and $3.19 per gallon for the entire year.

Petroleum: U.S. crude oil production is expected to increase by 5.4 percent in 2023 and 6.7 percent in 2024 compared to the production levels in 2022., with stocks currently higher than the previous year. Petroleum prices are projected to average $73.62 per barrel in 2023.

Distillate Fuels: In 2023, regional refineries are expected to produce an average of 845 million gallons of distillate fuel oil per month, a marginal increase of 0.6 percent compared to 2022. National inventories of distillate oil were 106.7 million barrels for the week ending May 26, slightly higher than the previous year, while Midwest inventories were 24.8 million barrels, slightly lower. Despite strong national production levels and robust export market, distillate stocks have struggled to build due to the balance between demand, net exports, and production. Ultra-low sulfur diesel fuel accounts for 99 percent of distillate demand, mainly for highway truck transportation. Distillate usage in Michigan follows seasonal peaks in Spring, late Summer, and early Fall due to factors like farming, increased vessel activity, and industrial production.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL