Natural Gas Prices Projected to Increase in 2024 as Demand Grows Faster Than Supply: EIA

U.S. natural gas prices during 2023 were relatively lower, due to increases in natural gas supply surpassing the rise in natural gas demand, according to a Feb. 12 report from the U.S. Energy Information Administration. Domestic gas production and imports were robust during 2023, amid a backdrop of high U.S. natural gas storage levels. In contrast, during 2024, the agency is expecting increases in natural gas demand to outpace increases in natural gas supply. In addition, the agency forecasts supply and demand for natural gas to increase at similar rates during 2025. The EIA forecasts that the majority of the increase in U.S. natural gas supply will come from domestic production of associated natural gas, primarily from the Permian region of western Texas and eastern New Mexico.

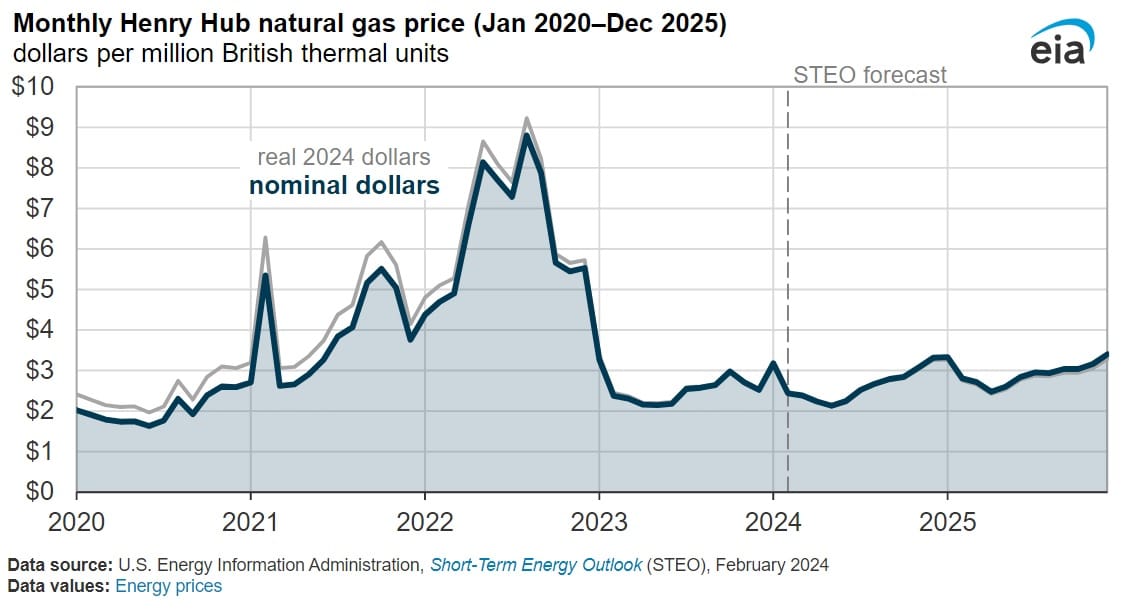

The agency projects average U.S. benchmark Henry Hub spot natural gas prices to remain below $3 per million British thermal units (MMBtu) during 2024 and 2025, according to a report published on Feb. 12. Average U.S. spot natural gas prices during 2024 and 2025 are forecast to be higher than in 2023, due to natural gas demand growth outpacing supply growth during the respective periods.

Natural gas storage sites will help to dampen price volatility and keep a lid on prices during 2024 and 2025. As of the end of January 2024, U.S. natural gas inventories are seven percent higher for this point in time, than the previous five-year average (2019-23). The agency expects U.S. natural gas stocks to remain higher than the previous five-year average throughout 2024 and 2025.

Natural gas consumption is projected to grow in the majority of the sectors in 2024, apart from the industrial sector which is expected to decline marginally. A key determinant of natural gas consumption is weather and as a result colder temperatures in the winter, will impact the residential and commercial sectors. The agency projects total consumption in the residential and commercial sectors to be five percent higher in 2024 than in 2023 because January 2023 and December 2023 had above seasonal normal temperatures, which led to relatively weaker consumption of natural gas for heating.

U.S. gas exports are expected to be impacted by the timing of the new LNG export terminals. Market participants expect three new terminals to come online during the second half of 2024 and in 2025. The forecast takes into account the possibility of delays due to the recent announcement by the U.S. Energy Department to pause applications to export LNG to countries with which the U.S. does not have a free trade agreement.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL