Nearly 20 Percent of PJM Region’s Current Coal-Fired Generating Capacity to Retire by 2028: EIA

The utilization of coal in the electricity generation mix in the PJM Interconnection region has declined over the last 10 years, due largely to higher relative fuel costs, according to a June 17 report published by the U.S. Energy Information. Competitive pressure from other energy sources, particularly natural gas has led to lower coal utilization in the generation mix. Over the last decade, natural gas combined cycle plants have doubled in PJM, the largest wholesale market in the country, operating across 13 states and the District of Columbia.

U.S. power grid operators have increasingly dispatched natural gas fired generation to fulfil higher electricity demand since 2014, and natural gas production has also risen at the same time. More efficient combined cycle gas turbine power generators, increased accessibility and comparatively low natural gas prices have made gas fired generation economical to operate and as result elevating the usage of natural gas as a power source compared with coal. U.S. natural gas fired generation capacity has increased by 19 percent, or 79 gigawatts (GW), since 2014 and generation has grown 60 percent, or 675,000 gigawatthours.

The significant increase in capacity and competitiveness of natural gas combined cycle plants has led to lower generation from PJM’s coal fleet and led to an increasing number of retirements. Since 2013, operators have closed around 34 GW of coal capacity in the PJM region and switched around 2 GW of coal capacity to other energy sources, primarily gas.

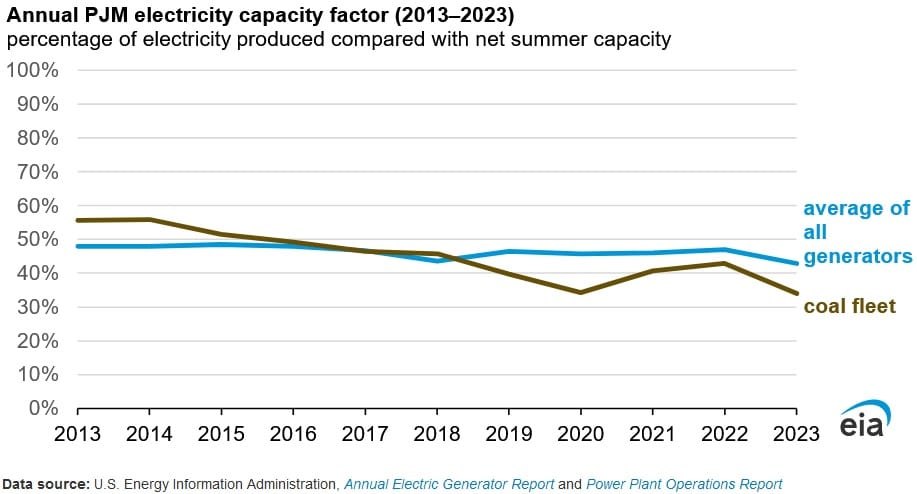

As of 2023, the use of coal fired generation in PJM declined to 34 percent of capacity, having been at 38 percent in 2013. In 2023, coal as a fuel in the generation mix accounted for 14 percent of PJM’s generation, while making up 18 percent of its generating capacity. In 2013, the capacity factor of coal power plants in the market was 56 percent, when coal fired electricity accounted for 44 percent of the market’s production.

Operational costs of alternative fuels are key drivers for PJM to determine which power plants will operate. The number of a plant is called on impacts the operator’s choice to keep coal fired plants open. A number of other factors such as wholesale commodity costs, maintenance expenditures, debt service, fuel supply contracts and local demand determine both dispatch and retirement decisions.

As it stands, PJM still has a significant number of independent power producers (IPP), despite IPP coal plants contributing to most of the retired coal capacity since 2013. Coal remains the third largest energy source in PJM, following natural gas and nuclear. Coal fired power generation still remains a vital source of electricity generation, however the increasing competitive price pressures from natural gas and renewable generation has led operators to make the decision to retire around 20 percent of the current coal capacity by 2028.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL