New Projects Expand Permian Basin Gas Pipeline Capacity: EIA

Natural gas pipeline takeaway volume in the Permian Basin is expected to increase with the Matterhorn Express Pipeline projected to become operational this month, according to a Sept. 10 report by the U.S. Energy Information Administration. This pipeline has a capacity of 2.5 billion cubic feet per day (Bcf/d).

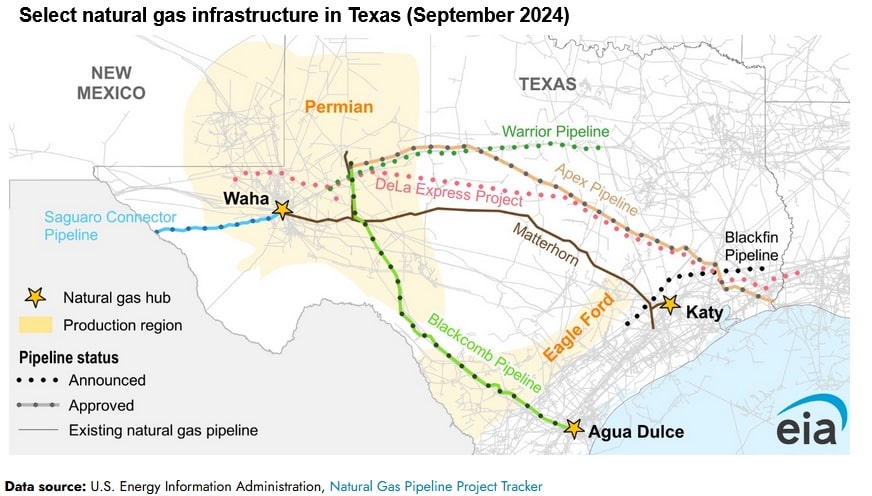

Matterhorn will carry gas from the Permian Basin to Katy near Houston in Texas. Gas production from the Permian Basin has risen significantly since 2018. As a result of the excess supply fundamentals, regional spot prices have declined and there has been elevated demand for new pipeline takeaway capacity to carry the gas to markets requiring the commodity.

Three new Permian Basin pipeline projects with a total capacity of 7.3 Bcf/d have also been signed off and are currently in various phases of development. The Apex pipeline is projected to become operational in 2026, the pipeline has a capacity of 2 Bcf/d and is intended to carry gas from Permian Basin to Port Arthur in Texas. The Blackcomb pipeline is also projected to become operational in 2026, the pipeline has a capacity of 2.5 Bcf/d and is planned to carry gas from Permian Basin to Agua Dulce in South Texas. The Saguaro Connector pipeline is expected to become operational in 2027-28. The pipeline has a capacity of 2.8 Bcf/d and is intended to carry gas from the Permian Basin to the U.S.- Mexico border.

Other pipeline projects with a combined capacity of 7 Bcf/d have also been announced by pipeline operators. The pipelines are projected to become operational between 2025 and 2028 and will be intended to carry gas from the Permian Basin to demand centers along the Texas Gulf Coast and Mexico.

Spot natural gas prices at the Waha Hub, which is positioned close to Permian Basin production, have traded below zero for 46 percent of the trading days during this year. The low pricing can be attributed to regional growth in gas production outpacing pipeline takeaway capacity additions. The difference in prices between the Waha Hub and the Henry Hub are impacted by pipeline conditions. The spread between the hubs expands under constrained pipeline situations and narrows when the constraints ease.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL