North America’s LNG Export Capacity Projected to Rise Significantly Through 2027: EIA

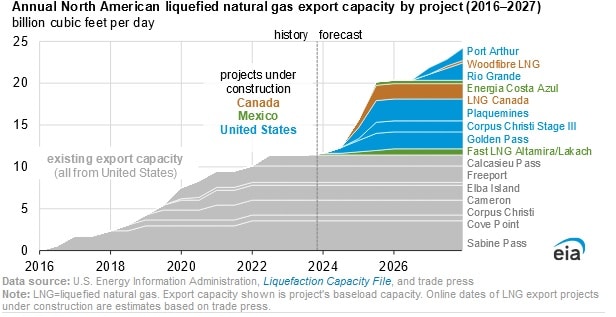

North America’s liquefied natural gas export capacity is expected to increase to 24.3 billion cubic feet per day (Bcf/d) by 2027, according to a Nov. 13 report published by the U.S. Energy Information Administration. Currently, North American LNG export capacity stands at 11.4 Bcf/d. The increase in LNG export capacity can be attributed to Canada and Mexico having their first LNG export terminals coming online and the U.S. adding to its current LNG capacity.

LNG exports have become more profitable for North American producers since the Russian invasion of Ukraine. Higher gas prices in the UK, European and Asian markets have made profitability margins attractive for North American sellers, amid a structural shift in trading dynamics, following the cessation of Russian pipelined gas to Europe. U.S. LNG exports averaged 11.6 Bcf/d during the first half of 2023, up by 0.5 Bcf/d or 4 percent compared to the same period in 2022. The increase can be attributed to a number of reasons including higher LNG export capacity, elevated global natural gas, and LNG prices, and firm global demand, most notably in Asia.

Increasing profitability of LNG exports for producers has been the underlying driver behind the construction and financing of new projects. The agency projects LNG export to increase by 1.1 Bcf/d in Mexico, 2.1 Bcf/d in Canada and 9.7 Bcf/d in the U.S. by the end of 2027.

Three new projects are under construction in Mexico, the Fast LNG Altamira offshore and onshore and Fast LNG Lakach, which are on Mexico’s east coast, and Energia Costa Azul, situated on Mexico’s west coast. Two export projects with a joint capability of 2.1 Bcf/d are under construction in British Columbia and on Canada’s west coast. LNG Canada is projected to come online in 2025, with an export capacity of 1.8 Bcf/d, whilst the Woodfibre LNG terminal with a export capacity of 0.3 bcf/d is expected to begin exporting in 2027. Five LNG export developments are currently underway with a total LNG export capacity of 9.7 Bcf/d —Golden Pass, Plaquemines, Corpus Christi Stage III, Rio Grande, and Port Arthur. As it stands, contractors project exports from Golden Pass and Plaquemines to commence in 2024.

North American LNG export capacity investment decisions will continue to be driven by prices in global gas markets. If a situation occurs, where global gas prices decline then there could be a delay in the number of projects coming online by 2027.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL