PJM Capacity Auction Clears at Record High Prices as Data Center Load Intensifies Supply Concerns

PJM Interconnection on Dec. 17 announced the results of its 2027/2028 capacity auction, which cleared at a record high price and highlighted growing concerns that electricity demand is rising faster than new generation is being added across the region. The grid operator procured 134,479 megawatts of accredited generation and demand response capacity through the centralized auction. Utilities meeting obligations outside the auction secured an additional 11,299 megawatts, bringing total committed capacity to 145,777 megawatts.

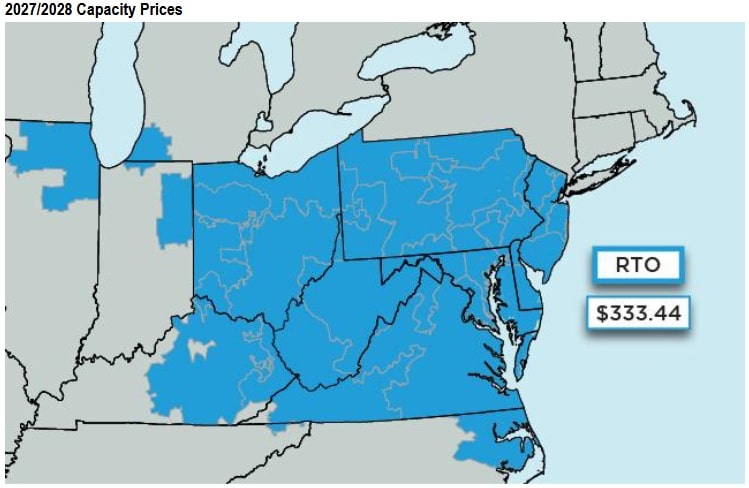

The auction cleared at $333.44 per megawatt day across the PJM footprint, the highest price in the history of the capacity market and the maximum level permitted under a federal regulator approved cap. The price reflects a roughly 1.3 percent increase from the previous auction and was influenced by temporary limits applied to the capacity demand curve for the 2026/2027 and 2027/2028 delivery years.

Despite the record clearing price, the total amount of committed capacity fell short of PJM’s reliability requirement by 6,623 megawatts. As a result, the system is projected to carry a reserve margin of 14.8 percent, below the level associated with the one event in 10 years reliability standard. PJM indicated that this outcome does not necessarily signal reliability risks for the delivery year, citing several mitigating factors. These include the potential for forecast peak demand to decline, the possibility that generators with announced retirements may continue operating, and the availability of winter-only resources expected to perform during periods of highest system stress.

PJM reported that forecast peak demand for the 2027/2028 delivery year increased by about 5,250 megawatts compared with the prior auction. Nearly all of that increase is attributable to large data center development, underscoring how energy intensive facilities are reshaping load forecasts and contributing to tighter supply and demand conditions.

The cleared resource mix remained dominated by conventional generation, led by natural gas, nuclear, and coal resources. Demand response accounted for about 5 percent of cleared capacity, with recent rule changes increasing its accredited value by expanding availability requirements.

Moving forward, PJM plans to conduct an incremental auction in February 2027. The next base capacity auction for the 2028/2029 delivery year is scheduled for June 2026 as the grid operator works to return to a long term planning cycle.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL