Port of Baltimore Closure Impacts U.S. Energy Trade: EIA

Shipping traffic from the Port of Baltimore, the second-largest coal exporting hub in the U.S., has temporarily paused after the collapse of the Francis Scott Key Bridge into the Patapsco River on March 26, according to a report published by the U.S. Energy Information Administration. This has impacted U.S. energy related trading dynamics.

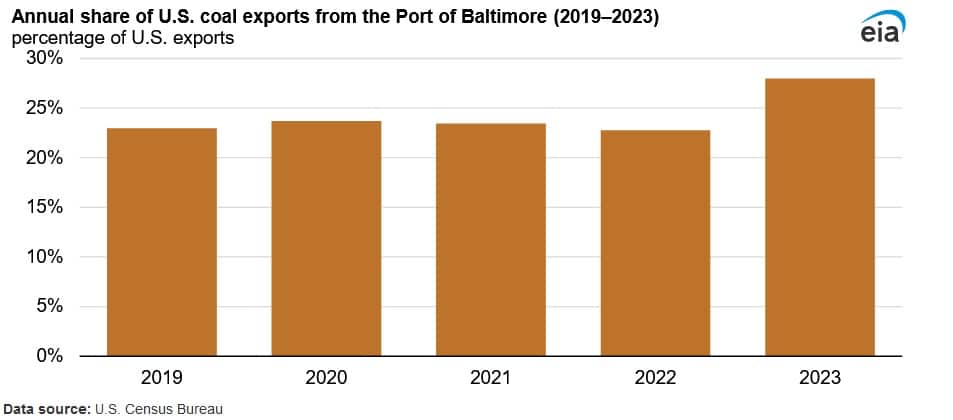

The Port of Baltimore accounted for 28 percent of overall coal exports in 2023, according to the U.S. Census Bureau. Coal exports from Baltimore increased to 28 million short tons in 2023, due to expanding demand for U.S. coal in Asia. The agency is projecting a slowdown in growth of U.S. coal exports in 2024 and the disruption in operations more recently is expected to impact the volume of coal exported.

Steam coal is widely utilised for electric power production and industrial heating and is the leading type of coal distributed from the Port of Baltimore. Steam coal shipments exported from the Port of Baltimore averaged approximately 12 million short tons from 2019 to 2022 and increased to 19 million tons in 2023. India has been the largest importer of U.S. steam coal exported from Baltimore over the last five years, with the brick manufacturing industry being the largest consumer.

Metallurgical coal distributed from the Port of Baltimore have also been significant over the last few years and have ranged from six million short tons to 10 million short tons between 2019 to 2023. Japan has been the largest importer of metallurgical coals exported from the Port of Baltimore over the last five years, followed by China and South Korea.

Apart from the Port of Baltimore, other neighbouring ports, such as Hampton Roads, have additional capacity to export coal, however the ability to export from this port depends on a number of factors which include pricing, coal quality, and how effortlessly companies can shift to exporting from another port.

In terms of other energy products, an inadequate volume of refined petroleum products are imported into the Port of Baltimore. The largest refined petroleum products are biodiesel feedstock and other edible oils, which averaged 3,000 barrels per day of imports in 2023. Additional petroleum derived products, such as fertiliser, asphalt, and other chemicals are also transported into the Port of Baltimore. Moreover, Baltimore imports the largest amount of urea ammonium nitrate on the U.S. Atlantic Coast. Other commonly utilised petroleum products are less impacted.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL