Red Sea Vessel Diversions Lead to Longer Shipping Times and Higher Freight Rates: EIA

Houthi led militia attacks on commercial ships passing through the Red Sea since November 2023 has led some vessels to avoid the Bab el-Mandeb checkpoint, which is the southern entrance to the Red Sea, according to a Feb. 1 report published by the U.S. Energy Information Administration. Commercial ships are opting to take the longer and more expensive route around the Cape of Good Hope.

Ships travelling between Europe and Asia through the Suez Canal would pass via the Bab-el-Mandeb Strait, which links the Read Sea to the Gulf of Aden. During the first half of last year, 12 percent of seaborne oil trade and eight percent of liquefied natural gas (LNG) trade came through the Bab-el-Mandeb Strait. However, more recently due to the ongoing conflict, a number of major oil and natural gas companies are avoiding the Red Sea, including Equinor, British Petroleum, Euronav, Shell, Reliance, Torm and QatarEnergy.

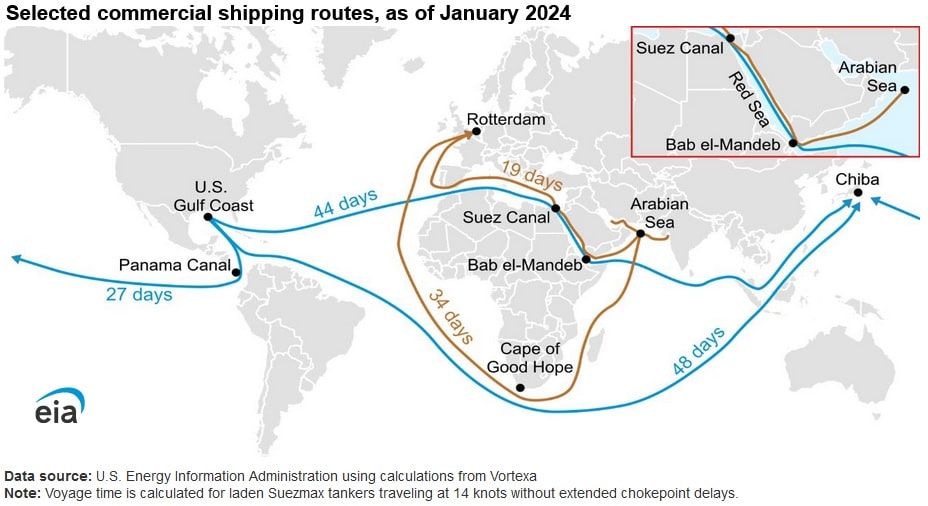

An alternative route to the Red Sea is to go around southern Africa, through the Cape of Good Hope. Travelling the Cape of Good Hope route has significantly increased voyage times, contingent on the ship’s start point and final destination. As an example, a typical journey from the Persian Gulf to the Amsterdam-Rotterdam-Antwerp (ARA) trading hub through the Suez Canal takes on average 19 days. In contrast, the alternative Cape of Good Hope route takes approximately 35 days.

Lengthier routes to avoid the Suez Canal are increasing freight rates because of reduced available ships and higher fuel usage and therefore costs. A Very Large Gas Carrier usually consumes around $30,000 to $35,000 worth of fuel per day, assuming the fuel is high sulphur bunker fuel based on average 2023 prices. The additional time spent on sea, is increasing fuel costs as well reducing the availability of ships, since assignments are taking longer. As a result, fewer available ships are further contributing to higher tanker rates and costs.

The flow of natural gas, refined products and oil passing via the Bab-el-Mandeb declined, following Houthi led militia attacks in November. Approximately 18 percent less crude oil flowed via the Bab-el-Mandeb during December, compared to the average between January to November 2023. Clean petroleum product flows via the Bab-el-Mandeb declined by 30 percent in December, compared to the average between January to November 2023. LNG flows via Bab-el-Mandeb declined by 24 percent in December, compared to the average between January to November 2023.

Tanker rates for routes that cross via the Bab-el-Mandeb and Suez Canal rose during December 2023, due to the enduring conflict in the Red Sea. Ships travelling via the Red Sea are now having to pay higher risk insurance premiums and these costs are being passed on to tanker rates.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL