Regional Gasoline Prices Rise Due to Midwest Refinery Outages: EIA

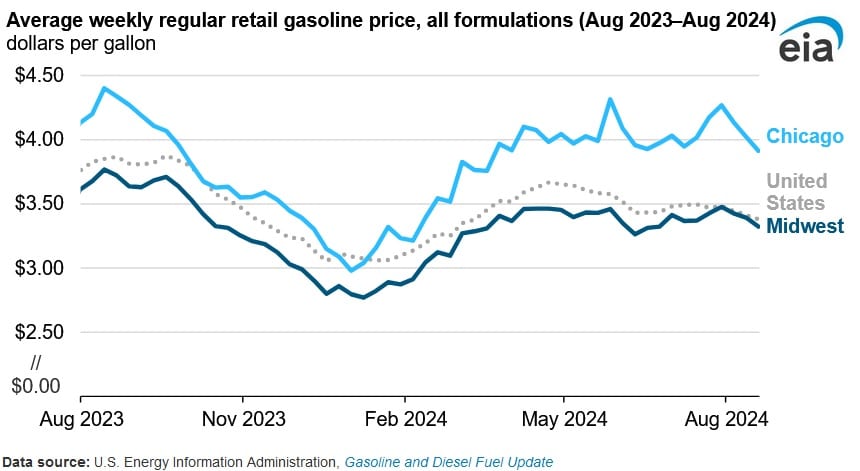

A number of refinery shutdowns in Ohio and Chicago have increased Midwest prices for petroleum products relative to the U.S. average, most notably for gasoline, according to an Aug. 22 report published by the U.S. Energy Information Administration. The outages have led to an unusual reduction in refining activity during the high demand summer period and have consequently led to a reduction in regional inventories.

ExxonMobil’s Joliet refinery on July 15 was closed down on an emergency basis due to a power outage as a result of severe weather conditions. The outage led to the refinery being offline for a number of weeks. The refinery has a capacity of 251,800 barrels per day (b/d). On Aug. 8, the facility resumed operations and market participants have indicated recently that the facility has continued with normal operations.

Operators also reported temporary unit shutdowns at Cenovus’s 183,000 b/d Lima and 150,800 b/d Toledo refineries. From the week ending July 12 to Aug. 9, Midwest refinery utilization declined 11 percentage points to 86 percent, as a result of outages, reducing refinery production of diesel, gasoline, and other refined petroleum products. Utilization rose by more than 10 percentage points the following week (Aug. 16) to 97 percent, due to the refineries restarting operations.

Reduced refinery utilization meant refineries produce lower quantities of gasoline, which led to significant reductions on Midwest gasoline inventories. Following the Joliet outage, in the week ending July 19, the inventories declined by 2 million barrels, dropping below the 2023 level and the five year (2019-2023) low.

Throughout Aug. 9, weekly inventory data showed that Midwest gasoline stocks remained at around 46 million barrels, which was between four and seven percent below the five-year average, depending on the week. During the week of Aug.16, gasoline stocks rose by 1.3 million barrels due to the refineries returning back online. Despite the increase in gasoline stocks, below average inventories continued to provide underlying support for Midwest gasoline prices.

The average price of retail gasoline in the Midwest has been within one percent of the U.S. average for three consecutive weeks following the shutdowns. Retail gasoline prices in the Midwest have generally been lower than the U.S. average, due to lower regional fuel taxes and firm production from local refineries.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL