RGGI Carbon Auction Sells Out, Allowance Prices Hit Five-Year High

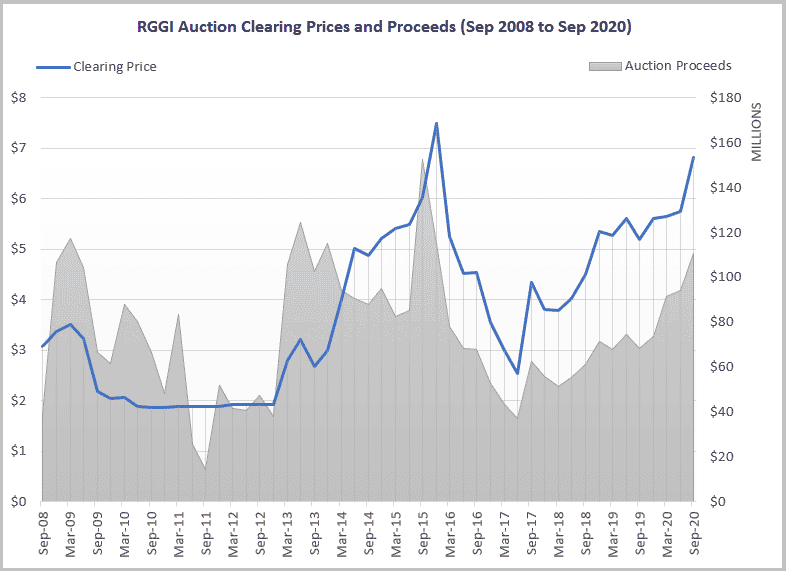

The 49th quarterly carbon auction of the Regional Greenhouse Gas Initiative, the nation’s first market-based program to cut power sector emissions, sold nearly 16.2 million carbon allowances at a clearing price of $6.82, according to a Sept. 4 news release. The clearing price is the highest since the December 2015 auction, which cleared at $7.50. The auction generated about $110.4 million, bringing the total proceeds to nearly $3.66 billion.

The clearing price is about 20 percent higher than the previous auction’s price of $5.75. Clearing prices have improved since the June 2017 RGGI auction, when prices dropped to their lowest level.

RGGI’s secondary market report issued on Aug. 2020 shows that the elevated trading activity triggered by the COVID-19 pandemic in the first quarter did not continue into the second quarter. The trading volume of RGGI futures was 23.8 million allowances in Q2 2020, down 51 percent from Q2 2019.

In the latest auction, compliances entities – firms with compliance obligations – purchased 74 percent of the allowances sold. Compliance-oriented entities, which acquire and hold allowances to meet their obligations, bought 66 percent of the permits. None of the 11.8 million cost containment reserve, or CCR, allowances were sold. The CCR is a fixed additional supply of allowances that are made available for sale if allowance prices exceed certain price levels.

RGGI’s market-based approach sets an annually declining limit on carbon emissions and allows polluters to buy or sell permits. RGGI now has 10 member states following the re-entry of New Jersey which began participating in the auctions since March after almost a decade.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL