Russia-Ukraine Conflict Pushing Transition to Sustainable, Secure Energy System: IEA World Energy Outlook

The International Energy Agency (IEA) on Oct. 27 released the World Energy Outlook 2022, which covers a variety of topics which range from causes of the energy crisis, the roadmap to net zero emissions, energy security, and the outlook for demand.

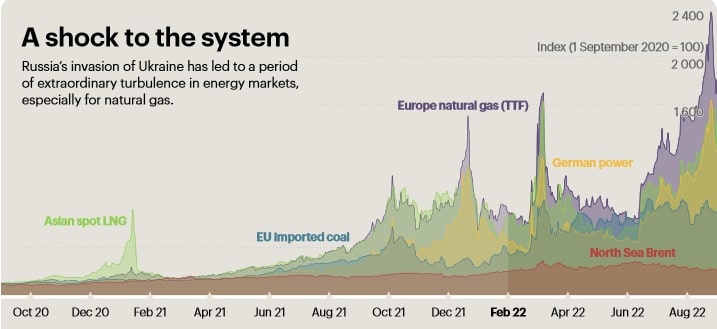

Russia’s invasion of Ukraine initiated the globe’s first energy crisis and has led to fundamental changes in global trade dynamics and to increased complexity. Uncertainty and volatility in energy markets predate Russia’s invasion of Ukraine. During the COVID-19 pandemic there was significant price unpredictability, however the market was on a gradual recovery, leading into 2021. This recovery was short lived, with the Russian invasion leading to an unprecedented energy crisis.

Russia’s curtailment of natural gas to supply to Europe and European sanctions on oil and coal imports from Russia are impacting global trade routes. As a result, the EU is now importing a higher number of liquified natural gas (LNG) cargoes from the U.S. The procurement of LNG cargoes at higher prices, compared to the traditional pipeline imports of Russian gas, has exposed consumers to higher energy bills and businesses to turndown production, in order to overcome the price turmoil. The reduction in Russian gas towards Europe has led to potential supply shortages.

Accordingly, governments have so far committed around $500 billion, mainly in developed economies, to protect customers from the near-term negative impacts. Governments have attempted to procure other fuel supplies and make certain sufficient gas storage. Other short‐term acts have involved expanding oil‐ and coal‐fired electricity production, extending the duration of some nuclear power facilities, and fastening the implementation of new renewables projects. Furthermore, the recently enacted Inflation Reduction Act in the U.S., Europe’s increased push for clean energy, and major new policies have raised the cost advantages of mature clean energy technologies as well as the prospects for new ones, such as hydrogen. This in turn is a boost for the emerging clean energy economy.

Combined with short‐ term actions, governments are now employing longer‐term measures to tackle the energy crisis. Governments aim to expand or diversify oil and gas supply; with many aiming to implement and escalate structural change.

The also notes that markets have begun rebalance, and renewables with the support of nuclear power, are witnessing continual gains. Moreover, the increase in coal generation, amid the energy crisis, is expected to be temporary. Looking forward in terms of supply, the increase in renewable electricity production is expected to outperform expansion in total electricity generation, pushing lower the influence of fossil fuels for electricity generation. The energy crisis temporarily increased utilization rates for existing coal‐fired plants but is not expected to increase investment in new ones.

Reinforced policies, a restrained economic viewpoint and high near‐term prices combine to diminish overall energy demand growth. As it stands, energy demand is being driven by increases from India, Southeast Asia, Africa, and the Middle East. However, the increase in China’s energy consumption, which has been a pivotal driver for global energy over the last 20 years, declines and then halts entirely before 2030 as China transitions to a more services‐focused financial economy.

World Energy Outlook 2022

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL