Sour Crude Oil Prices Rise Amid OPEC+ Production Cuts: EIA

Medium, sour and heavy, sour grades of crude oil prices have increased on the back of crude oil production cuts among OPEC+ producers, according to a Sept. 25 report by the U.S. Energy Information Administration.

OPEC+ members in June 2023, stated they would persist with crude oil production reductions through 2024, curbing crude oil supplies, particularly sour crude oils. Moreover, Saudi Arabia, a top producer, declared it would cut crude oil production by 1 million barrels per day for July. Thereafter, the voluntary production reductions were implemented several times before Saudi Arabia announced on Sep.5 that these cuts would be extended till the end of 2023.

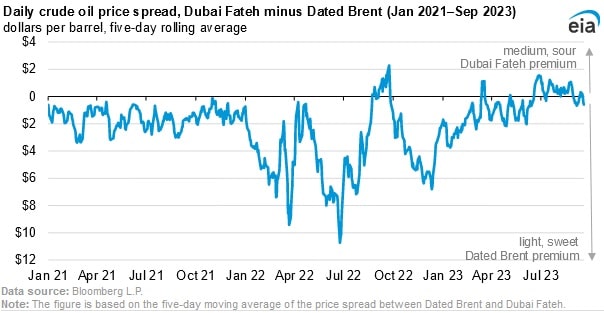

The OPEC+ led production reductions are increasing prices for these grades compared with sweet crude oils, and the current spreads are in contrast to historical price relationships. Historically, light, sweet crude oil prices are valued at a premium in comparison to any other sour crude oil since sweet crude oils cost less to refine and produce greater yields of more significant products. Dated Brent was valued at an average premium of $2.5 per barrel compared with Dubai Fateh between January 4, 2021 and June 20,2023.

However, over the last few months, medium, sour Dubai Fateh traded at a premium to light, sweet Dated Brent. Between June 21 and Sept. 19, the Dubai Fateh traded at an average premium of $0.48 per barrel compared to the Dated Brent. The Norwegian Johan Sverdrup, a medium, sour crude oil followed a similar trend.

The agency’s Short Term Energy Outlook reports that OPEC crude oil production averaged 27 million barrels per day in August, the lowest since August 2021 and Saudi Arabian crude oil production averaged 8.7 million barrels per day, the lowest since May 2021. The reduction in Saudi Arabian production has had a more significant impact on sour prices than sweet, since the majority of Saudi Arabia’s crude oil encompasses more than 1 percent sulfur, the agency’s base level for classing crude oil as sour.

Another factor impacting the spread between sour and sweet has been Saudi Arabia raising the official selling price of Arab Light, a medium sour crude oil to Asia and Europe. As it stands, the scope and length of the current market dynamics, with sour crude oil price trading historically high, remain tentative, amid a number of supply and demand factors in the background.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL