State Tax Rates for Retail Gasoline and Diesel Largely Unchanged Since July 2024: EIA

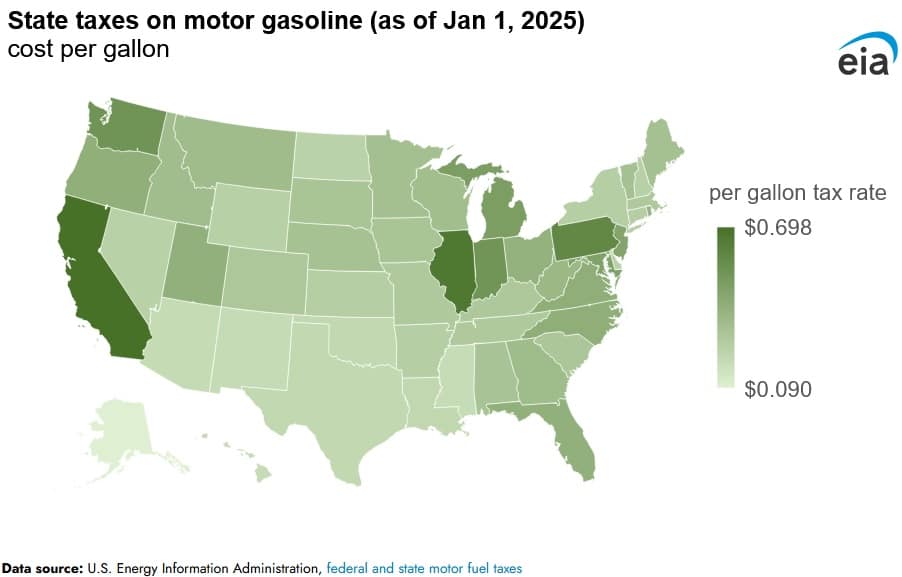

State taxes and fees on gasoline and diesel fuel as of the start of 2025 have averaged $0.33 per gallon (gal) of gasoline and $0.35/gal of diesel fuel, according to a Feb. 21 report published by the U.S. Energy Information Administration. Average taxes on diesel and gasoline have remained largely flat, rising by less than half of one cent each.

Federal tax rates continue to be at $0.244/gal for diesel and $0.184/gal for gasoline, which consists of excise duty and an added $0.001/gal for the Leaking Underground Storage Tankv (LUST) Fund. States utilize money from the LUST fund to support underground storage tank cleanup and prevention programs. States utilize LUST fund cleanup money to manage corrective actions by responsible parties; and clean-up sites that require prompt action to protect the environment and human health.

Federal and state taxes often comprise small fees that fund environmental protection and other vital funds. The federal and state governments utilize majority of the income to build and sustain roads and other transportation infrastructure. Federal and state taxes are applied at the wholesale level in the product distribution stream. The businesses involved in these transactions pay the taxes, but the cost is passed on to the ultimate consumer as part of the market price for the product.

A number of changes occurred in several states, despite national average tax rates being largely flat. Gasoline taxes declined in six states, with the largest decrease being in Indiana where taxes fell by $0.036 to $0.525/gal. In contrast, gasoline taxes rose in eight states, with the largest increase being in Minnesota where taxes increased by $0.031 to $0.319/gal. Diesel fuel taxes declined in four states, with the tax decline in Michigan of $0.036/gal being the largest. In contrast, diesel taxes rose in nine states, with the largest increase in Connecticut where taxes increased by $0.032/gal to $0.524/gal.

Alaska, Mississippi and Hawaii have the lowest gasoline and diesel taxes. California, Illinois and Pennsylvania have the highest gasoline and diesel taxes. This is consistent with the agency’s previous publication during August 2024.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL