U.S. Coal Exports to Europe Increase Amid Sanctions on Russian Coal: EIA

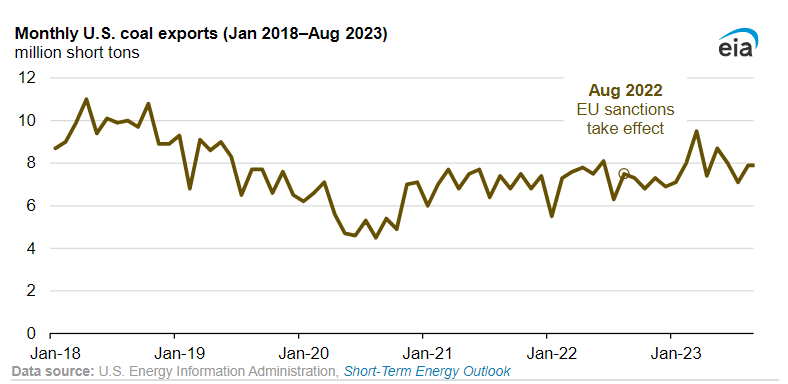

U.S. coal exports to Europe increased by 22 percent to 33.1 million short tons (MMst) between August 2022 and July 2023, compared to the same period before the implementation of EU sanctions on coal from Russia (August 2021 – July 2022), according to a Nov. 2 report published by the U.S. Energy Information Administration. In response to the Russian invasion of Ukraine, the EU banned coal imports from Aug. 10, 2022 as part of a sanctions package against Russia that was declared in April 2022.

The Russian invasion of Ukraine has contributed to higher demand for U.S. coal and led to a structural shift in the market, which has impacted trading dynamics for a number of energy sources. Russian pipelined gas to Europe has significantly declined since the Russian invasion of Ukraine. As a result, the EU is relying on other fuel sources for electricity generation, with European gas prices trading at record prices and therefore being an expensive input fuel, the European demand for coal has increased.

Historically, the EU has been a large importer of Russian coal. In 2021, the EU imported 84.6 MMst of coal from Russia, accounting for around a third of Russia’s total exports. Since the sanctions implemented by EU policymakers on domestic buyers, European coal imports from Russia fell to zero. In response to firm EU coal demand, the U.S., and other countries such as South Africa and Colombia increased coal exports to the EU, in order to fill the supply gap.

Following the full implementation of European sanctions on Russian coal, the U.S. as a swing supplier in global steam coal markets, was appropriately positioned to export coal to Europe. From August 2022 to July 2023, U.S. exports of steam coal to Europe equaled 14.4 MMst, up 51 percent compared to the prior 12-month period. U.S steam coal is a natural substitute to that from Russia due to its similarity in quality, with both countries producing premium quality bituminous coal with a high heating value.

For the 12 months after the EU sanctions came into effect, exports of U.S. metallurgical coal to Europe rose by a mere six percent to 18.6 MMSt compared with the prior 12-month period. Metallurgical coal exports have remained more stable as the use of this coal is limited to iron and steel production.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL