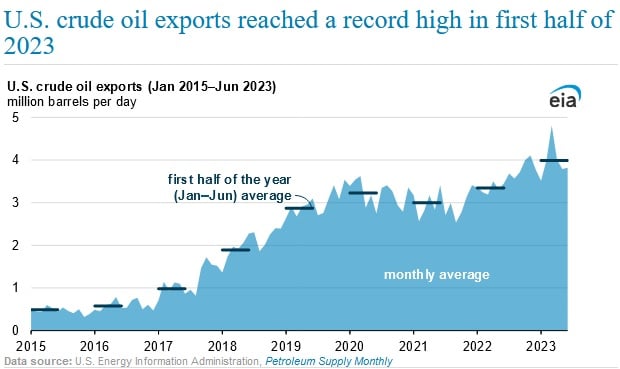

U.S. Crude Oil Exports at Record High During First Six Months of 2023: EIA

U.S. crude oil exports reached a record 3.99 million barrels per day (b/d) during the first six months of 2023, up 650,000 b/d compared to the same period in 2022, according to an Oct. 10 report issued by the U.S. Energy Information Administration. U.S. crude oil exports during the period were at their highest levels since 2015, when the U.S. ban on crude exports was overturned.

U.S. crude oil exports to Europe were recorded at 1.75 million b/d during the first six months of 2023 and was the largest regional destination, followed by Asia. The U.S. exported 1.68 million b/d to Asia, with strong exports to China and South Korea. Canada, Central and South America, and Africa were the other export destinations.

Despite record high exports during the first half of the year, the U.S. remains a net crude oil importer. Domestic crude oil production across the U.S. is expected to rise, according to the agency. The increase in oil production forecasts is on the back of higher projections of well level productivity and higher crude oil prices. Despite the rise in crude oil production, the U.S. continues to import crude, due to the type of crude oil produced. U.S. refineries are configured to process heavy, sour crude oil rather than the light, sweet crude oil usually produced In the U.S.

Mexico and Canada are the main crude oil exporters to the U.S. The U.S. usually imports crude oil when it is financially profitable for their refiners to process discounted heavier grades, since their refineries have already invested in the configuration essential to refine them. Heavy, sour grades of crude are often at a price discount to the light, sweet grades of sour as they require additional refinery work, in order for them to produce valuable products such as jet fuel and diesel.

U.S. domestic production of light, sweet crude oil increased in the early 2010’s. This oil type gains financially in the global market due to the price premium attached to it because they yield large amounts of profitable petroleum products from less complex, refining procedures. Refiners in the Midwest and along the Gulf Coast find refining of discounted heavy, sour crude oil grades profitable. Some on the Gulf Coast have made investments to expand light, sweet crude oil processing capacity.

In September, the agency reported that medium, sour and heavy, sour grades of crude oil prices have increased on the back of crude oil production cuts among OPEC+ producers.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL