U.S. Gasoline and Diesel Prices Increase Due to Reduced Refinery Activity: EIA

U.S. gasoline and diesel prices rose during February although retail average prices are below 2023 levels for this time of the year, according to a March 6 report published by the U.S. Energy Information Administration. The price increase can be attributed to the sharp decline in refinery utilization and decreasing regional inventories across the major U.S. refining regions.

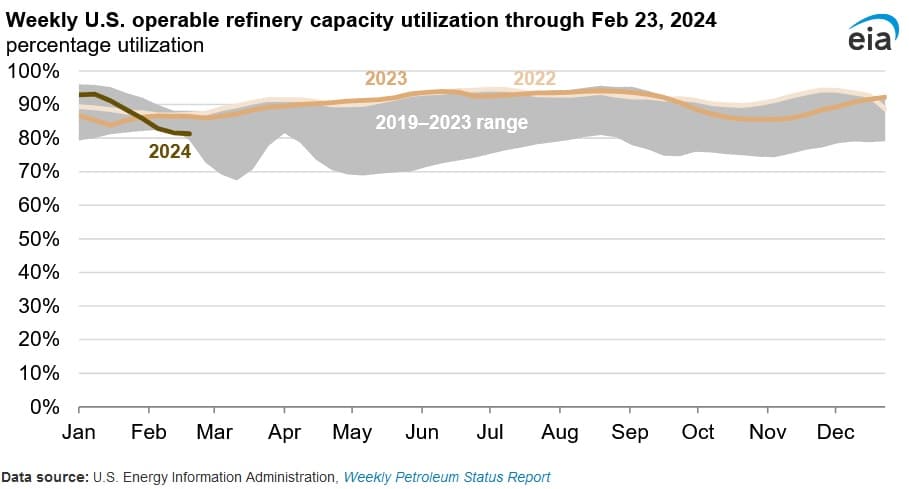

U.S. refinery utilization fell to around 81 percent during the two weeks ending February 9 and February 16 and has declined 11 percent since early January 2024. Moreover, U.S. refinery utilization at some points declined below the five year (2019-2023) low. The decrease is due to reduced plant operations in the Midwest and Gulf Coast regions as well as more intense seasonal patterns. The decline in refinery utilization has also had a significant impact on inventories.

The largest decline in refinery utilization has occurred in the U.S. Gulf Coast. The four-week average refinery utilization in this region has declined 14 percent since the first week of January and fallen below 80 percent over the last two weeks. The decline is due to adverse weather conditions and planned maintenance. In this region, weatherization against extreme cold is relatively less common, implying that extreme weather conditions can contribute to power outages or impairment to assets and therefore lead to provisional shutdowns.

Maintenance on Gulf Coast refinery assets commenced earlier than usual this year and has had a significant impact on output. Market participants report maintenance shutdowns are currently taking place at the Motiva Port Arthur and Marathon Galveston Bay refineries, which in total account for around seven percent of total U.S. capacity. In the Midwest, BP’s refinery in Whiting, Indiana was under maintenance due to an unplanned outage. This led to a 10 percent decline in Midwest regional refinery utilization since the first week of January.

Lower inventories of motor gasoline and diesel are currently evident in the U.S. market. This is the direct result of lower refinery output. The agency projects gasoline and diesel prices to increase, until more output is brought back online and stock levels increase.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL