U.S. LNG Imports Reached 15 Year Low During the First Half of 2022: EIA

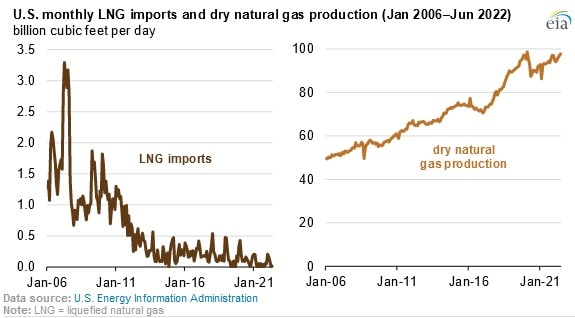

U.S. liquified natural gas (LNG) imports during the January-June 2022 period were recorded at their lowest level in at least 15 years, averaging 0.08 billion cubic feet per day (bcf/d), down by 60 percent compared with previous five year average of 0.2 bcf/d. At the same time, U.S. LNG exports have risen significantly, amid the Russian invasion of Ukraine. U.S. LNG exports to Europe have risen due to the higher price premium in the European market.

Between 2007 and 2021, LNG imports declined considerably and were replaced by U.S. dry natural gas production, which expanded by almost 8 percent. U.S. LNG imports historically rise in the winter period (October- March), when demand is significantly higher due to colder temperatures. During this period the majority of the natural gas imports into the U.S. comes via pipelines from Canada.

LNG imports in the U.S. were at their highest in April 2007 and accounted for 26 percent of the total gas imports (3.3 bcf/d). During the previous winter, LNG imports into the U.S. averaged 0.1 bcf/d, drastically lower than when LNG imports topped at an average of 1.8 bcf/d in the period 2006-2007. As it stands, LNG plays a substantially reduced role in the percent share of U.S. natural gas imports and accounted for less than one percent in 2021, in comparison to 17 percent in 2007.

Previous to 2010, the U.S. was developing its LNG import infrastructure, and as many as eight LNG import facilities were constructed between 2005 and 2011, totalling 12 LNG terminals and significantly increasing the U.S. import capability. At the same time, domestic gas production began to increase rapidly and ultimately a number of the LNG import facilities were reconfigured into LNG export terminals.

Gas production has increased in predominantly three production territories Appalachia, Permian, and Haynesville. Despite the increase in domestic production, LNG imports continue to be considered as a key marginal source of supply during periods of peak demand. On peak demand days, imported LNG can provide up to 35 percent of New England’s natural gas supply.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL