U.S. LNG Industry Advances Three Projects Amid Evolving Market Dynamics: EIA

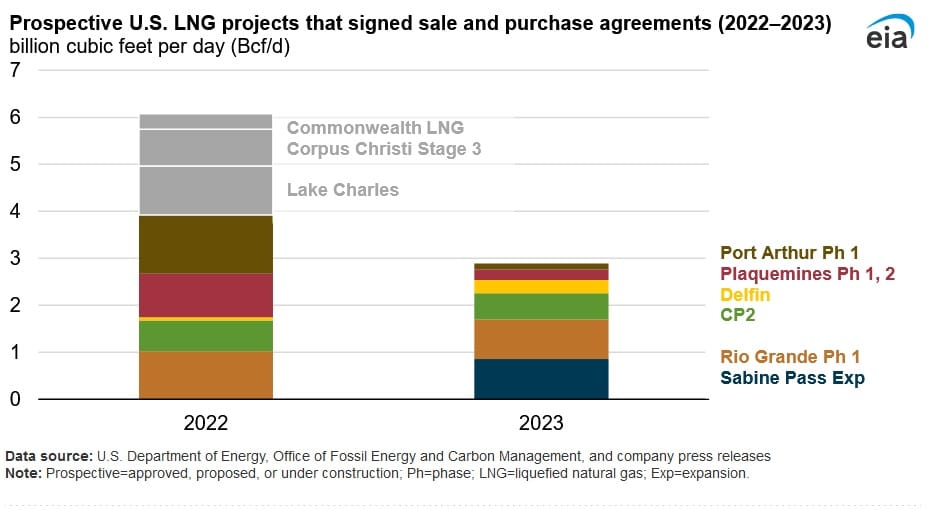

The U.S. liquefied natural gas industry experienced notable progress as three major projects commenced construction in 2023, as reported by the U.S. Energy Information Administration on Feb. 7. This advancement is fueled by the execution of sale and purchase agreements (SPAs) amounting to nearly 22 million metric tons per year of LNG, albeit reflecting a 52 percent decrease compared to 2022.

The final investment decisions for these projects occurred before the U.S. Energy Department announced a temporary pause last month on pending applications for the export of liquefied natural gas to non-Free Trade Agreement countries. Projects with final investment decisions in 2023 had secured export approvals, initiating construction in Louisiana and Texas with completion dates between 2024 and 2027.

The SPAs, featuring 20-year contracts predominantly based on a free-on-board sales model, showcased varied pricing mechanisms linked to the Henry Hub natural gas price or alternative benchmarks like oil prices, reflecting the complexity of global LNG markets. Additionally, the distribution of contracted LNG volumes between European and Asian offtake companies emphasized evolving market preferences, with most agreements offering flexible cargo destinations contingent upon regulatory compliance, indicating strategic adaptation to optimize market access.

Upcoming U.S. LNG Projects

The U.S. LNG industry is experiencing a notable growth phase, set to increase its base load capacity by 73.6 million metric tons per annum (MTPA) by 2028. This expansion is characterized by the advancement of multiple major projects, intended to bolster the nation’s standing as a prominent LNG exporter. Key projects which are to come online by 2028 include Golden Pass, Plaquemines LNG Phase 1 and 2, Corpus Christi Liquefaction Stage III, Port Arthur LNG Phase 1, and Rio Grande LNG Phase 1. The Plaquemines and Golden Pass Export projects are currently under construction and are expected to start operations in 2024.

In 2022, U.S. LNG developers signed contracts for approximately 6.0 billion cubic feet per day of LNG from eight projects in various stages of development. These contracts, known as sale and purchase agreements (SPAs), typically span over 10 years and define the terms of transfer between seller and buyer. Most SPAs are for 20-year terms, with LNG sold on a free-on-board basis, offering destination flexibility. Before 2022, Plaquemines and Rio Grande LNG had already secured significant commitments from buyers. Asian companies committed to purchasing 1.8 billion cubic feet per day, European companies to 1.2 billion cubic feet per day, and trading affiliates to 3.0 billion cubic feet per day of contracted volumes. Concerns about future natural gas supplies, especially in Europe following Russia’s invasion of Ukraine in February 2022, drove increased contracting with new U.S. LNG projects.

In 2023, Europe received over 60 percent of U.S. LNG exports, playing a vital role in replenishing its lost gas supplies after Russia’s invasion of Ukraine. By the end of the decade, an additional 12 Bcf/d of U.S. export capacity, already authorized and under construction, is expected to come online, potentially doubling U.S. exports.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL