U.S. Metallurgical Coal Sold at Premium of 90 Percent to Price of Thermal Coal: EIA

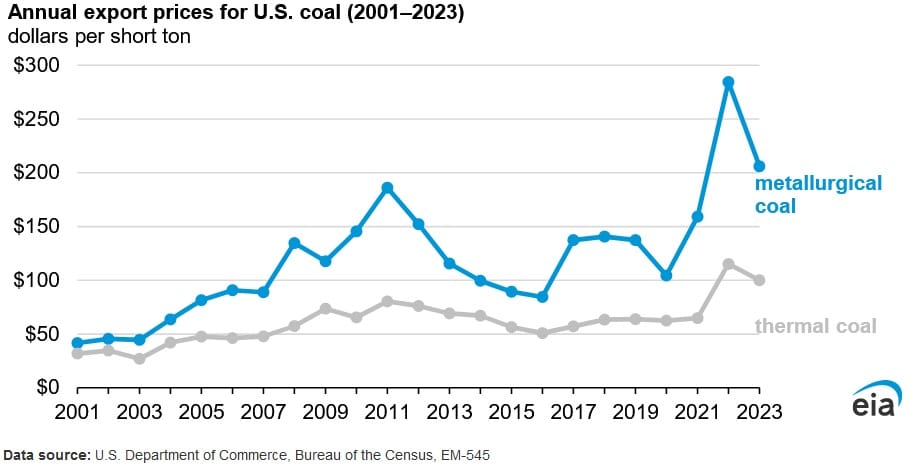

U.S. metallurgical coal, used mostly as a raw material in the steelmaking procedure has been sold on export markets for more than double the price of U.S. coal, used mostly as an input fuel during power production in six out of the last seven years, according to an April 24 report published by the U.S. Energy Information Administration. U.S. metallurgical coal from 2001 to 2023 sold on the export market at an average premium of 90 percent compared to the price of thermal coal.

U.S. metallurgical coal prices rose significantly following the Russian invasion of Ukraine, and the subsequent trade limitations on coal from Russia. The restriction on Russian coal on the export market, amid global supply chain disruptions incentivized metallurgical coal exports from the U.S. market. Metallurgical coal consists of around 10 percent of total U.S. coal output and the majority of the metallurgical coal is exported, as a result it is impacted by geopolitical events and producers can take advantage of the higher price on the international market. On the other hand, thermal coal is mostly used domestically. The agency reports that the amount of thermal coal exported hardly surpasses eight percent of its annual production. In contrast, of the projected 67 million short tons of coal produced in the U.S. during 2023, 76 percent or 51 million short tons was exported to steelmakers and coke producers around the globe.

The price increase in U.S. coal metallurgical coal markets can also be attributed to elevated demand from international pig iron blast furnace steel producers and lower competition in the metallurgical coal market compared to the thermal coal market. Australia, Russia and Canada are the only countries who have the ability and the reserves to produce and export vast volumes of metallurgical coal of similar quality to the U.S. China is a large producer of metallurgical coal, however all of its production is used domestically.

The fundamental difference between metallurgical and thermal coal is its production cost. Metallurgical coal is more expensive to produce. The cost of mining coal in the Appalachian region, where the majority of the U.S. coal reserves are, usually surpasses the cost of producing thermal coal, since majority of the metallurgical coal is mined from thinner seams. The cost of mining for metallurgical coal is higher and therefore the higher export price on the international market assists in compensating the cost.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL