U.S. Natural Gas Inventories to Remain High Through 2025: EIA

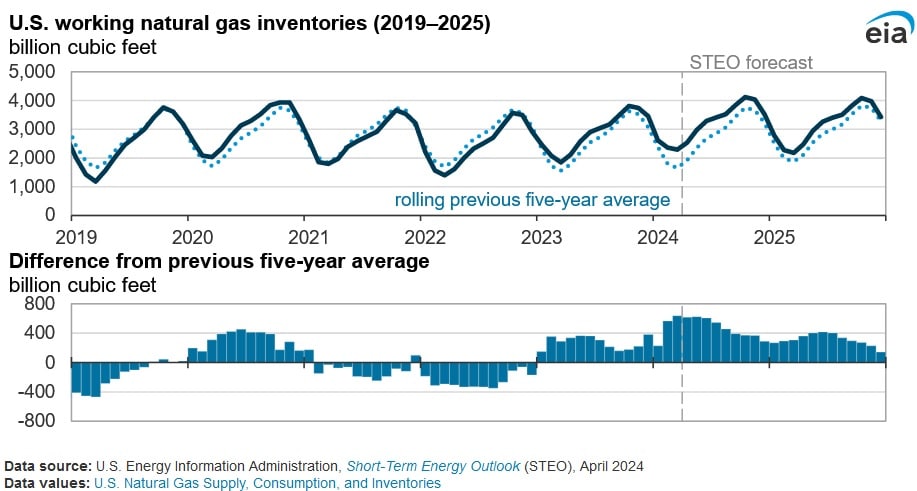

U.S. natural gas inventories are projected to remain comparatively high through 2025, according to an April 11 report published by the U.S. Energy Information Administration. High natural gas inventories are expected to dampen price volatility in U.S. gas markets and lead to relatively lower natural gas spot prices through 2025.

The U.S. ended the winter season with 2,290 billion cubic feet (Bcf) of gas in storage sites, 39 percent above the previous five-year average. The increase in storage capacity this winter compared to other winters can be attributed to mild weather, reduced consumption and robust natural gas production. According to the National Oceanic and Atmospheric Administration (NOAA) the U.S. experienced its warmest winter on record. Higher temperatures have led to lower gas demand for household consumption and therefore lower demand overall. Moreover, both the commercial and residential sectors used less gas than previous winters and as a result less gas was used from storage sites to fulfil demand. During this winter, around 1,500 Bcf of gas was withdrawn from storage sites compared to 2,000 Bcf during previous winters.

The NOAA reported above seasonal normal temperatures during December 2023 and that December 2023 was the warmest on record across a number of U.S. locations, particularly in the northern and central U.S. As a result of the warm weather, there was less demand for gas as a space heating fuel in both the commercial and residential sectors. Lower gas consumption led to lower gas storage withdrawals and accordingly elevated natural gas inventories. Comparatively milder 2023-24 winter led to natural gas consumption in both the residential and commercial sectors to average 35 Bcf/d, six percent less than in the previous winter and seven percent less than the previous five-year average.

Firm U.S. natural gas production during the winter further contributed to higher U.S. storage levels. Gas production averaged a record 106 Bcf/d and 107 Bcf/d during November and December, respectively. Robust production, amid lower demand led to lower U.S. spot gas prices. As a result, a number of producers during February and March announced current or planned production curtailments or reductions in capital expenditures towards natural gas focused activities this year.

The agency forecast Henry Hub gas prices to persist below $2/MMBtu until the second half of 2024 and average $2.2/MMbtu for the year.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL