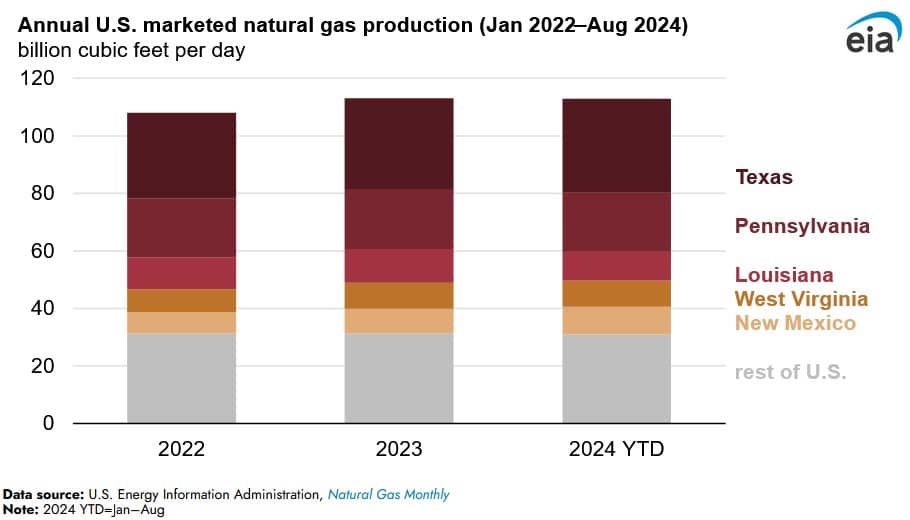

U.S. Natural Gas Production Hit Record High in 2023: EIA

Five states accounted for over 70 percent of the all-time high of 113.1 billion cubic feet per day (Bcf/d) of U.S. marketed natural gas production during 2023, according to an Dec. 10 report published by the U.S. Energy Information Administration. The state of Texas accounted for 28 percent of the total U.S. marketed natural gas production during 2023, followed by Pennsylvania (18 percent), Louisiana (10 percent), West Virginia (10 percent) and New Mexico (eight percent). As it stands, during 2024 production has slowed down, however these five states still account for 73 percent of total marketed U.S. natural gas.

Marketed natural gas production in Texas during 2023 totaled 31.6 Bcf/d, up seven percent from the previous year. The Permian region encompasses into New Mexico, where production averaged 8.7 Bcf/d during 2023, up 18 percent compared to last year. The majority of Permian production is associated natural gas from oil wells. As a result producers react to changes in the price of crude oil rather than the natural gas price when scheduling their production and exploration activities. Brent crude oil prices were more than 20 percent lower during 2023 compared to 2022, and accordingly marketed natural gas production in New Mexico and Texas set record highs during 2023.

Marketed natural gas production in Louisiana during 2023 totaled 11.8 Bcf/d, up six percent from the previous year, and is the most natural gas produced in the state since 1996. Natural gas production in Pennsylvania during 2023 totaled 20.9 Bcf/d, up one percent compared to 2022. Meanwhile, natural gas production in West Virginia reached a record high of 8.9 Bcf/d during 2023, up 11 percent compared to 2022.

Growth in U.S. marketed natural gas production has slowed in 2024, in line with reduced output from shale and tight formations. U.S. natural gas production from shale and tight formation marginally declined between January to September 2024, compared to the same period in 2023. Total U.S. shale gas production during the first nine months of 2024 declined by around one percent to 81.2 Bcf/d compared to the same months in 2023. The reduction in shale gas production during 2024 can be attributed to lower production in the Utica and Haynesville plays. During the first nine months of 2024, shale gas production declined by 10 percent or 0.6 Bcf/d in Utica and 12 percent or 1.8 Bcf/d in Haynesville compared to the same period during 2023. Natural gas prices are a key driver of drilling and developing wells in the three plays: Haynesville, Utica and Marcellus. U.S. natural gas prices on the Henry Hub benchmark have generally declined since August 2022, and hit record lows during the first six months of 2024. As a result of lower natural gas prices, drilling natural gas wells has become a less profitable activity.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL