U.S. Natural Gas Storage Injections Six Percent Higher This Summer Compared to Five Year Average: EIA

U.S. natural gas storage injections far this summer have exceeded the previous five year average (2018-2022), according to the U.S. Energy Information Administration. As of July 7, natural gas inventories totaled 2,930 billion cubic feet in the lower 48 states. U.S. gas prices have largely followed a downward trend during 2023, in line with robust gas production outpacing demand. The excess production has led to additional gas being injected into storage and as a result since April 1, net gas storage injections have exceeded the previous five year average by 66 bcf or 6 percent. Moreover, gas inventories have reached 69 percent of capacity so far during the injection season.

The key factor driving injection demand this year has been price. Henry hub front month future prices have averaged below $2.5 per million British thermal unit since February, and this has incentivised injection demand, since storage players believe at these prices injections will be financially profitable. The decision to inject gas is based on the price economics of withdrawals – storage owners would inject during the summer months at lower prices in anticipation of withdrawals in the winter months at significantly higher prices.

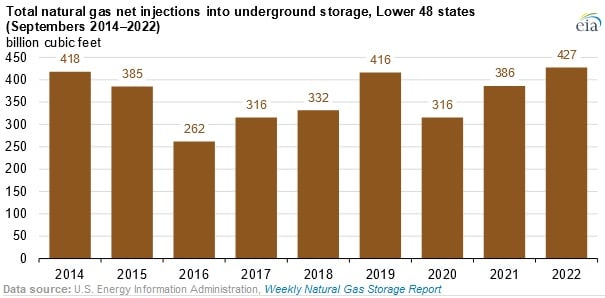

In the previous injections season, a significant amount of gas was injected into storage during September, due to reduced seasonal demand and strong natural gas production. The supply and demand fundamentals in the market are a key driver of gas storage injections in any given year. Last summer, low storage levels led to high natural gas prices and led prices to rise above $9/MMBtu, as storage injections began to increase prices eased, in line with the market pricing out risk premiums for potential gas shortages in the winter period.

In contrast to last year, natural gas stocks have been at a surplus to the five year average since January 2023. The excess reached a high in March and has remained above average since the start of the refill season in April. US natural gas prices have declined since January, from an average of $5.53/MMBtu in December 2022 and have averaged below $2.5/MMBtu since February.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL