U.S. Onshore Crude Output Tripled Since 2010 Driven by Permian Basin Tight Oil Production: EIA

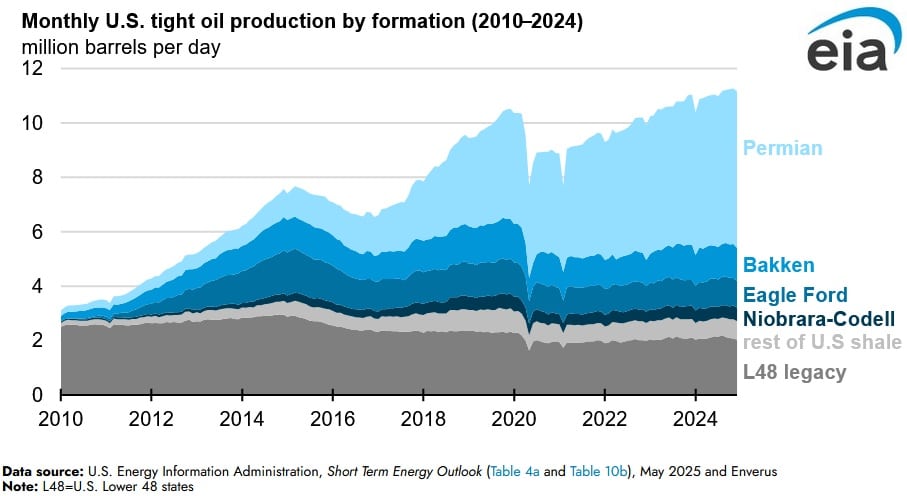

U.S. crude oil production has increased by more than threefold since January 2010, in line with tight oil production growth in the Permian region, according to a June 2 report published by the U.S. Energy Information Administration. Onshore crude oil production entails both newer tight oil production, mostly from horizontally drilled wells and legacy oil production, mostly from vertically drilled wells.

Legacy production declined by 0.5 million barrels per day (b/d) from 2010 to 2014 to 2.1 million b/d. Over the same period, tight oil production rose by 8.1 million b/d to 8.9 million b/d, accounting for 81 percent of total onshore oil production in 2024. The Permian accounted for 65 percent of all tight oil production growth and 51 percent of U.S. oil production during 2024.

U.S. tight oil production has increased in both the Permian and non-Permian region over the last 15 years. Tight oil production from non-Permian plays was lower during the 2015 to 2017 period due to low oil prices. At the start of 2020, tight oil production from the Permian region was largely equivalent to tight oil production from all other U.S. producing regions. Permian and non-Permian oil production both declined due to crude oil prices dropping below $50 per barrel (b) because of the coronavirus pandemic, with production reaching a yearly low during May 2020.

Oil companies are increasingly leveraging technological enhancements, including electronic hydraulic fracturing technologies, artificial intelligence and automated drilling procedures, to improve operations while operating fewer rigs. This alteration towards digital solutions has enhanced completion and drilling techniques and shortened rig downtime, and it offers innovative analytics to help target forthcoming operations. These technological innovations and results have permitted producers to elevate production rates for rigs as they drill new wells.

Tight oil production in the Permian region started increasing in 2021, in line with higher crude oil prices rose, but production in the non-Permian remained low. Within the Permian region, the Wolfcamp, Bone Spring, and Spraberry plays produce the majority of the tight oil, accounting for 99 percent of total Permian tight oil production during 2024.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL