U.S. Petroleum Demand Dips to Below 2019 Levels Due to COVID-Mitigation Efforts: EIA

U.S. petroleum demand is projected to see a widespread dip for the rest of the 2020 calendar year, according to a July 20 report from the U.S. Energy Information Administration. The forecast was the conclusion of successive decreases in demand through March and April 2020 primarily as a consequence of the COVID-19 pandemic. The EIA’s dossier on the matter published through its series of Short-Term Energy Outlook reports. The latest of these predicted an initial increase in petroleum demand in the latter half of 2020 as various industry practices resume after a hiatus, though demand rates will be lower on average as compared to 2019 until August 2021 at the least.

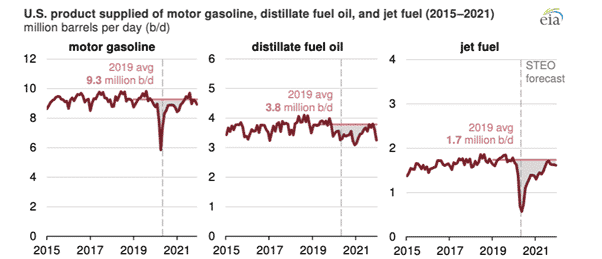

The forecast is also the culmination of several earth-shattering lows in the petroleum industry. In April 2020, the consumption of liquid fuels in the U.S. reached a nadir not seen since the early 1980s at an average of 14.7 million barrels per day (b/d). However, as several states across the country revive various economic sectors, an uptick has also been recorded: weekly consumption has steadily increased, as evinced above.

Jet fuel and motor oil consumption this year is expected to decrease by 31 percent and 10 percent, respectively as juxtaposed to rates at this time in 2019. Motor gasoline consumption hovered at 8.3 million b/d, while jet fuel consumption nosedived to 660,000 b/d in the second quarter of 2020. That being said, the report points out that an increase in employment shall positively affect motor oil numbers, and that its consumption rate will rise to 9.1 million b/d. Similarly, an increase in travel gradually will bump up jet fuel consumption rates up to an average of 1.5 million b/d. The projected increases for motor gasoline and jet fuel are 2 percent and 12 percent less than 2019 rates, respectively.

The report also addresses distillate consumption, which is more relevant to energy consumption in specific, non-commercial uses, such as building heating and construction machinery usage. Distillate use was not as affected by COVID-19 mitigation efforts, though lower rates were more likely the repercussion of economic stagnation rather than a decrease in travel activity.

EnerKnol Pulses like this one are powered by the EnerKnol Platform—the first comprehensive database for real-time energy policy tracking. Sign up for a free trial below for access to key regulatory data and deep industry insights across the energy spectrum.

ACCESS FREE TRIAL